Business, 27.01.2021 14:00 laylay2380

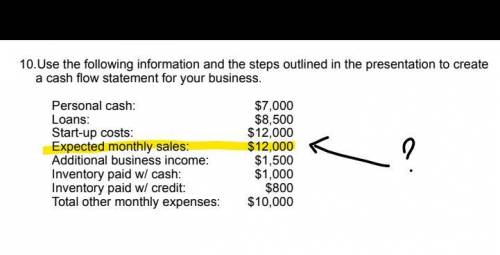

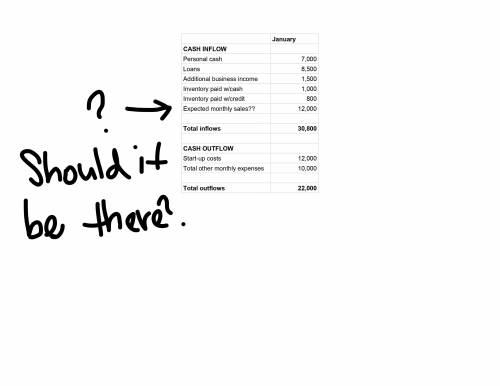

Should "Expected monthly sales" fall under cash inflow or cash outflow in a cash flow statement. I had to make a cash flow statement from info. given on my assignment. Don't really know where "expected monthly sales" should go. Need help.

Answers: 1

Another question on Business

Business, 21.06.2019 20:20

Jing-sheng facilitated a hiring committee for his advertising company. six employees (including two managers) met together to discuss applicants and select the finalists for a copywriter position in the public relations department. although the head of public relations would have the final nod on the candidate that would ultimately be hired, the evaluative work of the committee was very important because this group would send forward those persons they believed would be good work colleagues. in setting up this type of hiring process, the head of public relations was utilizing a(n) style of leadership.a. autocraticb. free-reinc. contingentd. participative

Answers: 3

Business, 22.06.2019 02:20

The following information is available for jase company: market price per share of common stock $25.00 earnings per share on common stock $1.25 which of the following statements is correct? a. the price-earnings ratio is 20 and a share of common stock was selling for 20 times the amount of earnings per share at the end of the year. b. the market price per share and the earnings per share are not statistically related to each other. c. the price-earnings ratio is 5% and a share of common stock was selling for 5% more than the amount of earnings per share at the end of the year. d. the price-earnings ratio is 10 and a share of common stock was selling for 125 times the amount of earnings per share at the end of the year.

Answers: 1

Business, 22.06.2019 09:00

Harry is 25 years old with a 1.55 rating factor for his auto insurance. if his annual base premium is $1,012, what is his total premium? $1,568.60 $2,530 $1,582.55 $1,842.25

Answers: 3

Business, 23.06.2019 13:00

How should the financial interests of stockholders be balanced with varied interests of stakeholders? if you were writing a code of conduct for your company, how would you address this issue?

Answers: 2

You know the right answer?

Should "Expected monthly sales" fall under cash inflow or cash outflow in a cash flow statement.

I...

Questions

Chemistry, 16.04.2021 01:00

Computers and Technology, 16.04.2021 01:00

Business, 16.04.2021 01:00

Mathematics, 16.04.2021 01:00

Mathematics, 16.04.2021 01:00

Biology, 16.04.2021 01:00

History, 16.04.2021 01:00

English, 16.04.2021 01:00

Spanish, 16.04.2021 01:00

Mathematics, 16.04.2021 01:00