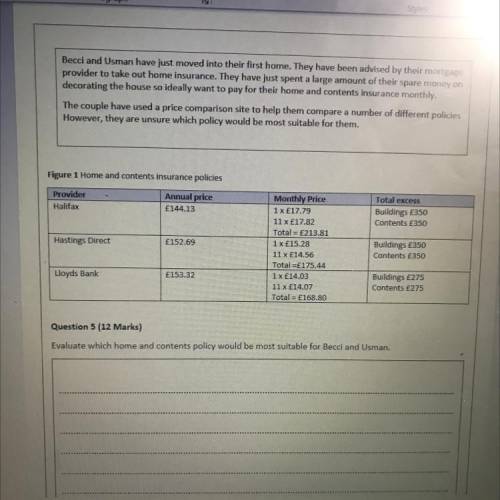

Becci and Usman have just moved into their first home. They have been advised by their mortgage

provider to take out home insurance. They have just spent a large amount of their spare money on

decorating the house so ideally want to pay for their home and contents insurance monthly

The couple have used a price comparison site to help them compare a number of different policies

However, they are unsure which policy would be most suitable for them.

Figure 1 Home and contents insurance policies

Provider

Halifax

Annual price

£144.13

Total excess

Buildings £350

Contents £350

Hastings Direct

€152.69

Monthly Price

1x €17.79

11XE17.82

Total = £213.81

1x £15.28

11x £14.56

Total £175.44

1x £14.03

11 x £14.07

Total = 168.80

Buildings £350

Contents £350

Lloyds Bank

E153.32

Buildings £275

Contents £275

Question 5 (12 Marks)

Evaluate which home and contents policy would be most suitable for Becci and Usman.

Answers: 1

Another question on Business

Business, 22.06.2019 03:30

Lo.2, 3, 9 lori, who is single, purchased 5-years class property for $200,00 and 7-years class property for $420,000 on may 20, 2018. lori experts the taxable income derived form the business (without regard to the amount expensed under ⧠179) to be about $550,000. lori has determined that she should elect immediate ⧠179 expensing in the amount of $520,000, but she doesn’t know which asset she should completely expense under ⧠179. she does not claim any available additional first-year depreciation. a. determine lori’s total cost recovery deduction if the ⧠179 expense is first taken with respect to the 5-year class asset. b. determine lori’s total cost recovery deduction if the ⧠179 expense is first taken with respect to the 7-year class asset. c. what is your advice for lori? d. assume that lori is in the 24% marginal tax bracket and that she uses ⧠179 on the 7-year asset. determine the present value of the tax savings from the depreciation deductions for both assets. see appendix g for present value factors, and assume a 6% discount rate. e. assume the same facts as in part (d), except that lori decides not to use ⧠179 on either asset. determine the present value of the tax savings under this choice. in addition, determine which option lori should choose. f. present your solution to parts (d) and (e) of the problem in a spreadsheet using appropriate microsoft excel formulas. e-mail your spreadsheet to your instructor with a two-paragraph summary of your findings.

Answers: 1

Business, 22.06.2019 17:20

“strategy, plans, and budgets are unrelated to one another.” do you agree? explain. explain how the manager’s choice of the type of responsibility center (cost, revenue, profit, or investment) affects the behavior of other employees.

Answers: 3

Business, 23.06.2019 01:00

The huntington boys and girls club is conducting a fundraiser by selling chili dinners to go. the price is $7 for an adult meal and $4 for a child’s meal. write a program that accepts the number of adult meals ordered and then children's meals ordered. display the total money collected for adult meals, children’s meals, and all meals.

Answers: 2

Business, 23.06.2019 01:50

In january, knox company requisitions raw materials for production as follows: job 1 $915, job 2 $1,590, job 3 $771, and general factory use $704. during january, time tickets show that the factory labor of $6,300 was used as follows: job 1 $2,344, job 2 $1,711, job 3 $1,554, and general factory use $691. prepare the job cost sheets for each of the three jobs.

Answers: 1

You know the right answer?

Becci and Usman have just moved into their first home. They have been advised by their mortgage

pro...

Questions

Mathematics, 20.09.2020 07:01

Mathematics, 20.09.2020 07:01

Mathematics, 20.09.2020 07:01

Chemistry, 20.09.2020 07:01

English, 20.09.2020 07:01

Mathematics, 20.09.2020 07:01

History, 20.09.2020 07:01

Chemistry, 20.09.2020 07:01

Mathematics, 20.09.2020 07:01

Mathematics, 20.09.2020 07:01