Business, 29.01.2021 16:30 kayla32213

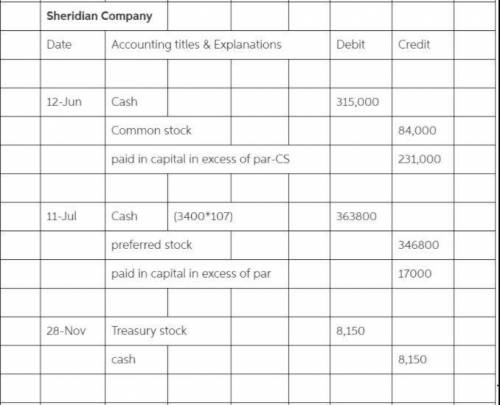

Sheridan Company had these transactions during the current period. June 12 Issued 84,000 shares of $1 par value common stock for cash of $315,000. July 11 Issued 3,400 shares of $102 par value preferred stock for cash at $107 per share. Nov. 28 Purchased 1,350 shares of treasury stock for $8,150.

Prepare the journal entries for the Sheridan Company transactions shown above.

On January 1, Marigold Corp. had 61,700 shares of no-par common stock issued and outstanding. The stock has a stated value of $4 per share. During the year, the following transactions occurred.

Apr. 1 Issued 12,600 additional shares of common stock for $12 per share.

June 15 Declared a cash dividend of $1.50 per share to stockholders of record on June 30.

July 10 Paid the $1.50 cash dividend.

Dec. 1 Issued 5,600 additional shares of common stock for $11 per share.

Dec. 15 Declared a cash dividend on outstanding shares of $1.70 per share to stockholders of record on December 31.

(a)Prepare the entries, if any, on each of the three dates that involved dividends.

Answers: 1

Another question on Business

Business, 21.06.2019 16:10

Reliable electric is a regulated public utility, and it is expected to provide steady dividend growth of 5% per year for the indefinite future. its last dividend was $6 per share; the stock sold for $50 per share just after the dividend was paid. what is the company’s cost of equity? (do not round intermediate calculations. enter your answer as a percent rounded to 2 decimal places.)

Answers: 2

Business, 22.06.2019 04:10

Lynch company manufactures and sells a single product. the following costs were incurred during the company’s first year of operations: variable costs per unit: manufacturing: direct materials $ 12 direct labor $ 6 variable manufacturing overhead $ 1 variable selling and administrative $ 1 fixed costs per year: fixed manufacturing overhead $ 308,000 fixed selling and administrative $ 218,000 during the year, the company produced 28,000 units and sold 15,000 units. the selling price of the company’s product is $56 per unit. required: 1. assume that the company uses absorption costing: a. compute the unit product cost. b. prepare an income statement for the year. 2. assume that the company uses variable costing: a. compute the unit product cost. b. prepare an income statement for the year.

Answers: 1

Business, 22.06.2019 11:30

11. before adding cream to a simmering soup, you need to a. simmer the cream. b. chill the cream. c. strain the cream through cheesecloth. d. allow the cream reach room temperature. student d incorrect which answer is right?

Answers: 2

Business, 22.06.2019 14:40

Which of the following statements about revision is most accurate? (a) you must compose first drafts quickly (sprint writing) and return later for editing. (b) careful writers always revise as they write. (c) revision is required for only long and complex business documents. (d) some business writers prefer to compose first drafts quickly and revise later; others prefer to revise as they go.

Answers: 3

You know the right answer?

Sheridan Company had these transactions during the current period. June 12 Issued 84,000 shares of $...

Questions

Chemistry, 01.02.2021 07:10

Business, 01.02.2021 07:20

Physics, 01.02.2021 07:20

Biology, 01.02.2021 07:20

History, 01.02.2021 07:20

Mathematics, 01.02.2021 07:20

Mathematics, 01.02.2021 07:20

Business, 01.02.2021 07:20

History, 01.02.2021 07:20