Simon Company’s year-end balance sheets follow.

At December 31 2015 2014 2013

Assets

C...

Business, 29.01.2021 17:10 emilyplays474

Simon Company’s year-end balance sheets follow.

At December 31 2015 2014 2013

Assets

Cash $ 31,800 $ 35,625 $ 37,800

Accounts receivable, net 89,500 62,500 50,200

Merchandise inventory 112,500 82,500 54,000

Prepaid expenses 10,700 9,375 5,000

Plant assets, net 278,500 255,000 230,500

Total assets $ 523,000 $ 445,000 $ 377,500

Liabilities and Equity

Accounts payable $129,900 $ 75,250 $ 51,250

Long-term notes payable secured by

mortgages on plant assets 98,500 101,500 83,500

Common stock, $10 par value163,500 163,500 163,500

Retained earnings 131,100 104,750 79,250

Total liabilities and equity$ 523,000 445,000 $ 377,500

The company’s income statements for the years ended December 31, 2015 and 2014, follow. Assume that all sales are on credit:

For Year Ended December 31 2015 2014

Sales $673,500 $532,000

Cost of goods sold $ 411,225 345,500

Other operating expenses 209,550 134,980

Interest expense 12,100 13,300

Income taxes 9,525 8,845

Total costs and expenses 642,400 502,625

Net income $ 31,100 $29,375

Earnings per share 1.90 $ 1.80

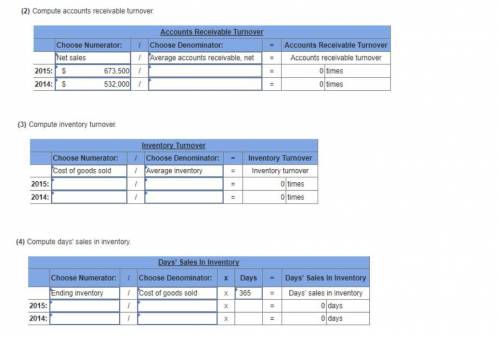

(1) Compute accounts receivable turnover.

(2) Compute inventory turnover.

(3) Compute days' sales in inventory.

Answers: 3

Another question on Business

Business, 22.06.2019 01:20

Suppose a stock had an initial price of $65 per share, paid a dividend of $1.45 per share during the year, and had an ending share price of $58. a, compute the percentage total return. (a negative answer should be indicated by a minus sign. do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. what was the dividend yield and the capital gains yield? (a negative answer should be indicated by a minus sign. do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)

Answers: 2

Business, 22.06.2019 05:00

At which stage would you introduce your product to the market at large? a. development stage b. market testing stage c. commercialization stage d. ideation stage

Answers: 3

Business, 22.06.2019 17:30

Costco wholesale corporation operates membership warehouses selling food, appliances, consumer electronics, apparel and other household goods at 471 locations across the u.s. as well as in canada, mexico and puerto rico. as of its fiscal year-end 2005, costco had approximately 21.2 million members. selected fiscal-year information from the company's balance sheets follows. ($ millions). selected balance sheet data 2005 2004 merchandise inventories $4,015 $3,644 deferred membership income (liability) 501 454 (a) during fiscal 2005, costco collected $1,120 cash for membership fees. use the financial statement effectstemplate to record the cash collected for membership fees. (b) in 2005, costco recorded $46,347 million in merchandise costs (that is, cost of goods sold). record thistransaction in the financial statement effects template. (c) determine the value of merchandise that costco purchased during fiscal-year 2005. use the financial statementeffects template to record these merchandise purchases. assume all of costco's purchases are on credit.

Answers: 3

Business, 22.06.2019 22:50

Awork system has five stations that have process times of 5, 9, 4, 9, and 8. what is the throughput time of the system? a. 7b. 4c. 18d. 35e. 9

Answers: 2

You know the right answer?

Questions

English, 01.09.2021 04:20

Mathematics, 01.09.2021 04:20

History, 01.09.2021 04:20

History, 01.09.2021 04:20

Health, 01.09.2021 04:20

Chemistry, 01.09.2021 04:20

Mathematics, 01.09.2021 04:20

Mathematics, 01.09.2021 04:20

History, 01.09.2021 04:20

Medicine, 01.09.2021 04:20

Mathematics, 01.09.2021 04:20

English, 01.09.2021 04:20

English, 01.09.2021 04:20