Business, 01.02.2021 23:50 Skylar8826

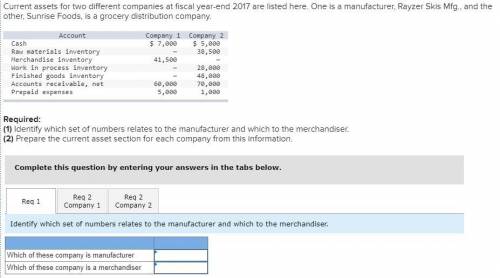

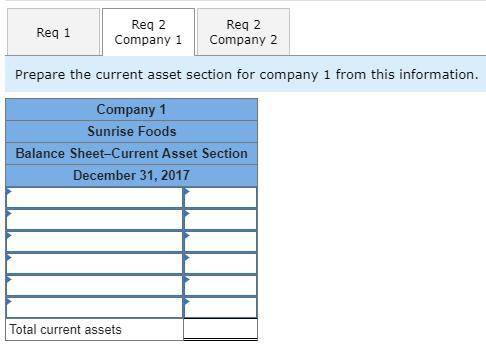

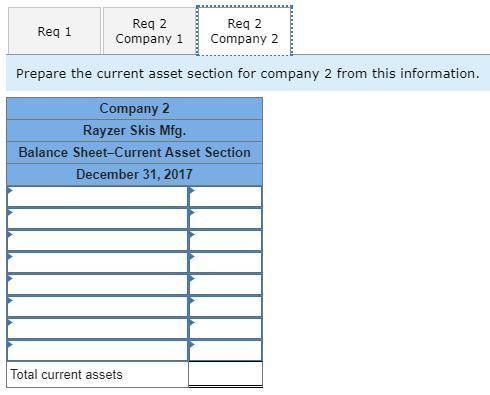

Current assets for two different companies at fiscal year-end are listed here. One is a manufacturer, Rayzer Skis Mfg., and the other, Sunrise Foods, is a grocery distribution company. Account Company 1 Company 2 Cash $ 13,000 $ 11,000 Raw materials inventory — 46,750 Merchandise inventory 49,750 — Work in process inventory — 34,000 Finished goods inventory — 54,000 Accounts receivable, net 58,000 72,000 Prepaid expenses 2,500 500 Required: 1. Identify which set of numbers relates to the manufacturer and which to the merchandiser. 2a. & 2b. Prepare the current asset section for each company from this information.

Answers: 1

Another question on Business

Business, 22.06.2019 10:30

Marketing1. suppose the average price for a new disposable cell phone is $20, and the total market potential for that product is $4 million. topco, inc. has a planned market share of 10 percent. how many phones does topco have the potential to sell in this market? 20,0002. use the data from question 3 to calculate topco, inc.'s planned market share in dollars. $400,0003. atlantic car rental charges $29.95 per day to rent a mid-size automobile. pacific car rental, atlantic's main competitor, just reduced prices on all its car rentals. in response, atlantic reduced its prices by 5 percent. now how much does it cost to rent a mid-size automobile from atlantic? $28.45

Answers: 1

Business, 22.06.2019 11:00

How did the contribution of the goods producing sector to gdp growth change between 2010 and 2011 a. it fell by 0.3%. b. it fell by 2.3%. c. it rose by 2.3%. d. it rose by 0.6%. the answer is b

Answers: 1

Business, 22.06.2019 13:50

The retained earnings account has a credit balance of $24,650 before closing entries are made. if total revenues for the period are $77,700, total expenses are $56,900, and dividends are $13,050, what is the ending balance in the retained earnings account after all closing entries are made?

Answers: 2

Business, 22.06.2019 15:00

Portia grant is an employee who is paid monthly. for the month of january of the current year, she earned a total of $8,388. the fica tax for social security is 6.2% of the first $118,500 earned each calendar year and the fica tax rate for medicare is 1.45% of all earnings. the futa tax rate of 0.6% and the suta tax rate of 5.4% are applied to the first $7,000 of an employee's pay. the amount of federal income tax withheld from her earnings was $1,391.77. what is the total amount of taxes withheld from the portia's earnings?

Answers: 2

You know the right answer?

Current assets for two different companies at fiscal year-end are listed here. One is a manufacturer...

Questions

English, 13.12.2019 23:31

History, 13.12.2019 23:31

History, 13.12.2019 23:31

History, 13.12.2019 23:31

Mathematics, 13.12.2019 23:31

Mathematics, 13.12.2019 23:31

Mathematics, 13.12.2019 23:31

Mathematics, 13.12.2019 23:31

Mathematics, 13.12.2019 23:31