Business, 02.02.2021 02:00 damondgriswold12

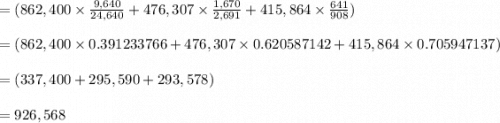

Look Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs). The company has two products, N06D and M09K, about which it has provided the following data: N06D M09K Direct materials per unit $ 33.40 $ 61.20 Direct labor per unit $ 6.00 $ 28.00 Direct labor-hours per unit 0.20 1.00 Annual production (units) 48,200 15,000 The company's estimated total manufacturing overhead for the year is $1,754,571 and the company's estimated total direct labor-hours for the year is 24,640. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below: Activities and Activity Measures Estimated Overhead Cost Supporting direct labor (DLHs) $ 862,400 Setting up machines (setups) 476,307 Parts administration (part types) 415,864 Total $ 1,754,571 Expected Activity N06D M09K Total DLHs 9640 15,000 24,640 Setups 1670 1021 2691 Part types 641 267 908 The manufacturing overhead that would be applied to a unit of product N06D under the company's traditional costing system is closest to: (Round your intermediate calculations to 2 decimal places.) Group of answer choices

Answers: 3

Another question on Business

Business, 22.06.2019 08:30

The production manager of rordan corporation has submitted the following quarterly production forecast for the upcoming fiscal year: 1st quarter 2nd quarter 3rd quarter 4th quarter units to be produced 10,800 8,500 7,100 11,200 each unit requires 0.25 direct labor-hours, and direct laborers are paid $20.00 per hour. required: 1. prepare the company’s direct labor budget for the upcoming fiscal year. assume that the direct labor workforce is adjusted each quarter to match the number of hours required to produce the forecasted number of units produced. 2. prepare the company’s direct labor budget for the upcoming fiscal year, assuming that the direct labor workforce is not adjusted each quarter. instead, assume that the company’s direct labor workforce consists of permanent employees who are guaranteed to be paid for at least 2,500 hours of work each quarter. if the number of required direct labor-hours is less than this number, the workers are paid for 2,500 hours anyway. any hours worked in excess of 2,500 hours in a quarter are paid at the rate of 1.5 times the normal hourly rate for direct labor.

Answers: 2

Business, 22.06.2019 11:30

Which of the following is not an example of one of the four mail advantages of prices on a free market economy

Answers: 1

Business, 22.06.2019 16:30

Bernard made a gift of $500,000 to his brother in 2014. due to bernard’s prior taxable gifts he paid $200,000 of gift tax. when bernard died in 2019, the applicable gift tax credit had increased. at bernard’s death, what amount related to the $500,000 gift to his brother is included in his gross estate?

Answers: 3

Business, 23.06.2019 00:00

Match each economic concept with the scenarios that illustrates it

Answers: 2

You know the right answer?

Look Manufacturing Corporation has a traditional costing system in which it applies manufacturing ov...

Questions

English, 16.11.2019 05:31