Business, 12.02.2021 16:10 riaahroo2378

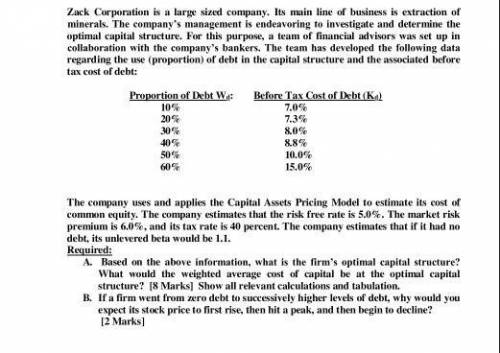

Zack Corporation is a large sized company. Its main line of business is extraction of minerals. The company's management is endeavoring to investigate and determine the optimal capital structure. For this purpose, a team of financial advisors was set up in collaboration with the company's bankers. The team has developed the following data regarding the use (proportion) of debt in the capital structure and the associated before tax cost of debt: Proportion of Debt W.: Before Tax Cost of Debt (K) 10% 7.0% 7.3% 30% 80% 40% 8.8% 50% 10,09 60% 15.0% 20% The company uses and applies the Capital Assets Pricing Model to estimate its cost of common equity. The company estimates that the risk free rate is 5.0%. The market risk premium is 6.0%, and its tax rate is 40 percent. The company estimates that if it had no debt, its unlevered beta would be 1.1. Required: A. Based on the above information, what is the firm's optimal capital structure? What would the weighted average cost of capital be at the optimal capital structure? [8 Marks] Show all relevant calculations and tabulation. B. If a firm went from zero debt to successively higher levels of debt, why would you expect its stock price to first rise, then hit a peak, and then begin to decline? [2 marks]

Answers: 1

Another question on Business

Business, 21.06.2019 17:50

Which of the following best explains why a large company can undersell small retailers? a. large companies can offer workers lower wages because they provide more jobs. b. large companies can pay their employees less because they do unskilled jobs. c. large companies can negotiate better prices with wholesalers. d. large companies have fewer expenses associated with overhead.

Answers: 1

Business, 22.06.2019 10:00

Your uncle is considering investing in a new company that will produce high quality stereo speakers. the sales price would be set at 1.5 times the variable cost per unit; the variable cost per unit is estimated to be $75.00; and fixed costs are estimated at $1,200,000. what sales volume would be required to break even, i.e., to have ebit = zero?

Answers: 1

Business, 22.06.2019 11:00

While on vacation in las vegas jennifer, who is from utah, wins a progressive jackpot playing cards worth $15,875 at the casino royale. what implication does she encounter when she goes to collect her prize?

Answers: 1

Business, 22.06.2019 11:00

Acoase solution to a problem of externality ensures that a socially efficient outcome is to

Answers: 2

You know the right answer?

Zack Corporation is a large sized company. Its main line of business is extraction of minerals. The...

Questions

Mathematics, 17.02.2020 04:27

Social Studies, 17.02.2020 04:28

Mathematics, 17.02.2020 04:28

Mathematics, 17.02.2020 04:29

Mathematics, 17.02.2020 04:29

Spanish, 17.02.2020 04:30