Business, 20.02.2021 02:00 logan541972

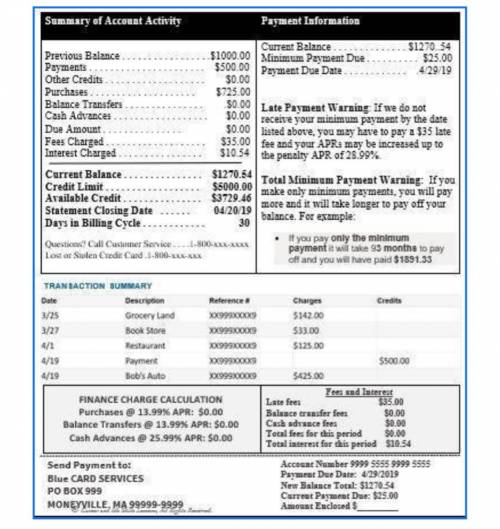

1. What is the current balance that Joe Doe owes? $1270.54

2.What is the total amount that Joe charged for this billing cycle?

a. List the purchases that Joe made.

3. How much did Joe pay for his last payment?

4. Why was Joe charged $35 by the credit card company?

5. How much interest was Joe charged for this month?

6. What is the credit limit that Joe has for this credit card?

a. What is Joe’s available credit?

7. What is APR for purchases for this credit card?

8. What is the minimum payment amount that Joe must make?

9. When is the due date for Joe to make a payment?

10. Did Joe take a cash advance on this credit card?

11.Why did you think the federal government requires that financial institutions place a “Total Minimum Payment Warning” on all credit card statements?

Answers: 3

Another question on Business

Business, 22.06.2019 00:40

Guardian inc. is trying to develop an asset-financing plan. the firm has $450,000 in temporary current assets and $350,000 in permanent current assets. guardian also has $550,000 in fixed assets. assume a tax rate of 40 percent. a. construct two alternative financing plans for guardian. one of the plans should be conservative, with 70 percent of assets financed by long-term sources, and the other should be aggressive, with only 56.25 percent of assets financed by long-term sources. the current interest rate is 12 percent on long-term funds and 7 percent on short-term financing. compute the annual interest payments under each plan.

Answers: 3

Business, 22.06.2019 01:00

Granby foods' (gf) balance sheet shows a total of $25 million long-term debt with a coupon rate of 8.50%. the yield to maturity on this debt is 8.00%, and the debt has a total current market value of $27 million. the company has 10 million shares of stock, and the stock has a book value per share of $5.00. the current stock price is $20.00 per share, and stockholders' required rate of return, r s, is 12.25%. the company recently decided that its target capital structure should have 35% debt, with the balance being common equity. the tax rate is 40%. calculate waccs based on book, market, and target capital structures. what is the sum of these three waccs?

Answers: 3

Business, 22.06.2019 11:00

Specialization—the division of labor—enhances productivity and efficiency by a) allowing workers to take advantage of existing differences in their abilities and skills. b) avoiding the time loss involved in shifting from one production task to another. c) allowing workers to develop skills by working on one, or a limited number, of tasks. d)all of the means identified in the other answers.

Answers: 2

Business, 22.06.2019 19:00

Tri fecta, a partnership, had revenues of $369,000 in its first year of operations. the partnership has not collected on $45,000 of its sales and still owes $39,500 on $155,000 of merchandise it purchased. there was no inventory on hand at the end of the year. the partnership paid $27,000 in salaries. the partners invested $48,000 in the business and $23,000 was borrowed on a five-year note. the partnership paid $2,070 in interest that was the amount owed for the year and paid $9,500 for a two-year insurance policy on the first day of business. compute net income for the first year for tri fecta.

Answers: 2

You know the right answer?

1. What is the current balance that Joe Doe owes? $1270.54

2.What is the total amount that Joe char...

Questions

English, 03.03.2021 15:30

English, 03.03.2021 15:30

Business, 03.03.2021 15:30

Computers and Technology, 03.03.2021 15:30

Mathematics, 03.03.2021 15:30

English, 03.03.2021 15:30

Mathematics, 03.03.2021 15:30

Mathematics, 03.03.2021 15:30

Mathematics, 03.03.2021 15:30

English, 03.03.2021 15:30

Computers and Technology, 03.03.2021 15:30

Mathematics, 03.03.2021 15:30

Mathematics, 03.03.2021 15:30

Mathematics, 03.03.2021 15:30

Computers and Technology, 03.03.2021 15:30