Answers: 3

Another question on Business

Business, 21.06.2019 16:20

Winston uses the high-low method. it had an average cost per unit of $10 at its lowest level of activity when sales equaled 10,000 units and an average cost per unit of $6.50 at its highest level of activity when sales equaled 20,000 units. what would winston estimate its total cost to be if sales equaled 8,000 units?

Answers: 3

Business, 21.06.2019 20:30

In general, as long as the number of firms that possess a particular valuable resource or capability is less than the number of firms needed to generate perfect competition dynamics in an industry, that resource or capability can be considered and a potential source of competitive advantage.answers: valuablerareinimitableun-substitutable

Answers: 1

Business, 22.06.2019 07:10

Walsh company manufactures and sells one product. the following information pertains to each of the company’s first two years of operations: variable costs per unit: manufacturing: direct materials $ 25 direct labor $ 12 variable manufacturing overhead $ 5 variable selling and administrative $ 4 fixed costs per year: fixed manufacturing overhead $ 400,000 fixed selling and administrative expenses $ 60,000 during its first year of operations, walsh produced 50,000 units and sold 40,000 units. during its second year of operations, it produced 40,000 units and sold 50,000 units. the selling price of the company’s product is $83 per unit. required: 1. assume the company uses variable costing: a. compute the unit product cost for year 1 and year 2. b. prepare an income statement for year 1 and year 2. 2. assume the company uses absorption costing: a. compute the unit product cost for year 1 and year 2. b. prepare an income statement for year 1 and year 2. 3. reconcile the difference between variable costing and absorption costing net operating income in year 1.

Answers: 3

Business, 22.06.2019 11:00

On analyzing her company’s goods transport route, simone found that they could reduce transport costs by a quarter if they merged different transport routes. what role (job) does simone play at her company? simone is at her company.

Answers: 1

You know the right answer?

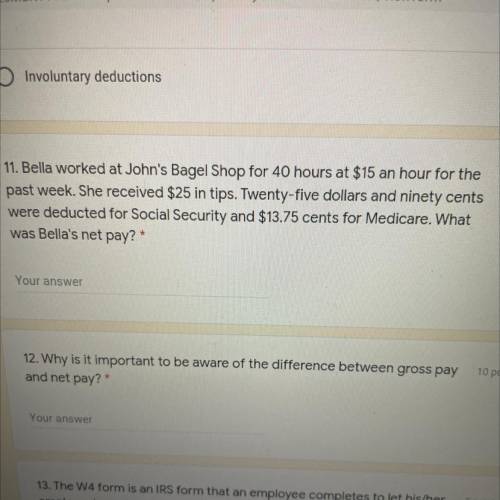

11, Bella worked at John's Bagel Shop for 40 hours at $ 15 an hour for the past week. She received $...

Questions

Mathematics, 01.03.2021 15:40

Mathematics, 01.03.2021 15:40

Mathematics, 01.03.2021 15:40

Chemistry, 01.03.2021 15:40

Mathematics, 01.03.2021 15:40

English, 01.03.2021 15:40

English, 01.03.2021 15:40

Mathematics, 01.03.2021 15:40

History, 01.03.2021 15:40

Mathematics, 01.03.2021 15:40

Mathematics, 01.03.2021 15:40

Mathematics, 01.03.2021 15:40

Computers and Technology, 01.03.2021 15:40

Mathematics, 01.03.2021 15:40