Business, 25.02.2021 19:00 davidjgonzalez9

American Food Services, Inc., acquired a packaging machine from Barton and Barton Corporation. Barton and Barton completed construction of the machine on January 1, 2016. In payment for the $4.7 million machine, American Food Services issued a four-year installment note to be paid in four equal payments at the end of each year. The payments include interest at the rate of 11%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)

Required:

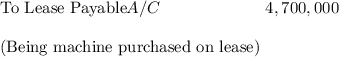

1. Prepare the journal entry for American Food Services’ purchase of the machine on January 1, 2016. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.)

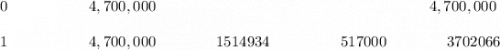

2. Prepare an amortization schedule for the four-year term of the installment note. (Enter your answers in whole dollars.

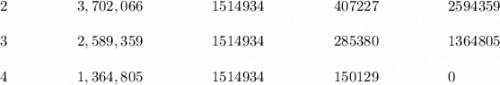

3. Prepare the journal entry for the first installment payment on December 31, 2016. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.)

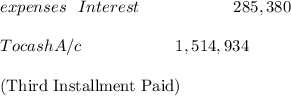

4. Prepare the journal entry for the third installment payment on December 31, 2018. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.)

Answers: 2

Another question on Business

Business, 21.06.2019 16:10

Belstone, inc. is a merchandiser of stone ornaments. it sold 15,000 units during the year. the company has provided the following information: sales revenue $ 520,000 purchases (excluding freight in) 338,500 selling and administrative expenses 32,000 freight in 15,000 beginning merchandise inventory 43,000 ending merchandise inventory 58,500 how much is the gross profit for the year?

Answers: 3

Business, 22.06.2019 00:00

Ok, so, theoretical question: if i bought the mona lisa legally, would anyone be able to stop me from eating it? why or why not?

Answers: 1

Business, 22.06.2019 11:40

In early january, burger mania acquired 100% of the common stock of the crispy taco restaurant chain. the purchase price allocation included the following items: $4 million, patent; $3 million, trademark considered to have an indefinite useful life; and $5 million, goodwill. burger mania's policy is to amortize intangible assets with finite useful lives using the straight-line method, no residual value, and a five-year service life. what is the total amount of amortization expense that would appear in burger mania's income statement for the first year ended december 31 related to these items?

Answers: 2

Business, 22.06.2019 23:50

Cash flows during the first year of operations for the harman-kardon consulting company were as follows: cash collected from customers, $360,000; cash paid for rent, $44,000; cash paid to employees for services rendered during the year, $124,000; cash paid for utilities, $54,000.in addition, you determine that customers owed the company $64,000 at the end of the year and no bad debts were anticipated. also, the company owed the gas and electric company $2,400 at year-end, and the rent payment was for a two-year period.calculate accrual net income for the year.

Answers: 2

You know the right answer?

American Food Services, Inc., acquired a packaging machine from Barton and Barton Corporation. Barto...

Questions

Mathematics, 20.02.2021 22:50

Arts, 20.02.2021 22:50

Mathematics, 20.02.2021 22:50

Mathematics, 20.02.2021 22:50

Mathematics, 20.02.2021 22:50

History, 20.02.2021 22:50

Social Studies, 20.02.2021 22:50

Health, 20.02.2021 22:50

Mathematics, 20.02.2021 22:50

Mathematics, 20.02.2021 22:50

Spanish, 20.02.2021 22:50

Geography, 20.02.2021 22:50

Arts, 20.02.2021 22:50

Social Studies, 20.02.2021 22:50