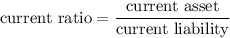

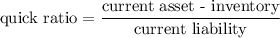

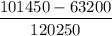

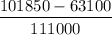

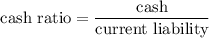

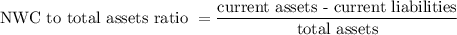

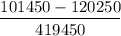

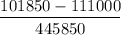

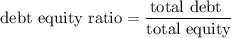

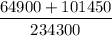

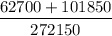

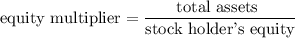

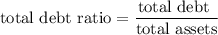

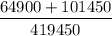

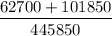

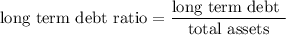

Just Dew It Corporation reports the following balance sheet information for 2017 and 2018. JUST DEW IT CORPORATION 2017 and 2018 Balance Sheets Assets Liabilities and Owners' Equity 2017 2018 2017 2018 Current assets Current liabilities Cash $10,450 $10,000 Accounts payable $70,750 $63,000 Accounts receivable 27,800 28,750 Notes payable 49,500 48,000 Inventory 63,200 63,100 Total $120,250 $111,000 Total $101,450 $101,850 Long-term debt $64,900 $62,700 Owners' equity Common stock and paid-in surplus $90,000 $90,000 Fixed assets Retained earnings 144,300 182,150 Net plant and equipment $318,000 $344,000 Total $234,300 $272,150 Total assets $419,450 $445,850 Total liabilities and owners' equity $419,450 $445,850Based on the balance sheets given for Just Dew It: a. Calculate the current ratio for each year. b. Calculate the quick ratio for each year. c. Calculate the cash ratio for each year. d. Calculate the NWC to total assets ratio for each year. e. Calculate the debt-equity ratio and equity multiplier for each year. f. Calculate the total debt ratio and long-term debt ratio for each year.

Answers: 2

Another question on Business

Business, 21.06.2019 19:40

Policymakers are provided data about the private and social benefits of a good being sold in the market. quantity private mb ($) social mb ($) 6 6 9 7 4 7 8 2 5 9 0 3 what is the size of the externality? if the externality is positive, enter a positive number. if negative, make it a negative number. $ given this data, policymakers must decide whether to address the associated externality with a subsidy or a tax. as their economic consultant, which of the two policy tools would you recommend? a subsidy a tax

Answers: 2

Business, 22.06.2019 14:00

Which of the following would be an accurate statement about achieving a balanced budget

Answers: 1

Business, 22.06.2019 15:00

Portia grant is an employee who is paid monthly. for the month of january of the current year, she earned a total of $8,388. the fica tax for social security is 6.2% of the first $118,500 earned each calendar year and the fica tax rate for medicare is 1.45% of all earnings. the futa tax rate of 0.6% and the suta tax rate of 5.4% are applied to the first $7,000 of an employee's pay. the amount of federal income tax withheld from her earnings was $1,391.77. what is the total amount of taxes withheld from the portia's earnings?

Answers: 2

Business, 22.06.2019 16:30

Why are there so many types of diversion programs for juveniles

Answers: 2

You know the right answer?

Just Dew It Corporation reports the following balance sheet information for 2017 and 2018. JUST DEW...

Questions

History, 30.11.2019 10:31

World Languages, 30.11.2019 10:31

Mathematics, 30.11.2019 10:31

Social Studies, 30.11.2019 10:31

Mathematics, 30.11.2019 10:31

Mathematics, 30.11.2019 10:31

Social Studies, 30.11.2019 10:31

Geography, 30.11.2019 10:31