On January 1, Year 1, Company A (the lessee) entered into an 8-year lease agreement with Company B (the lessor) for industrial equipment. Annual lease payments of $14,378 are payable at the end of each year. Company A's incremental borrowing rate is 7%, and the implicit rate in the lease is 5%, which is known to Company A. On January 1, Year 1, the fair value of the equipment is $125,000 and its estimated useful life is 15 years. Company A depreciates its long-lived assets in accordance with the straight-line depreciation method. At lease commencement date, Company B estimates that the total residual value of the equipment at the end of the lease term will be $47,388. Company A guarantees $40,000 of the residual value of the equipment. However, due to expected high usage of the equipment, Company A estimates that the value of the equipment at the end of the lease term will be only $30,000. Information on present value factors is as follows:

Present value of $1 at 5% for 8 periods0.6768

Present value of $1 at 7% for 8 periods0.5820

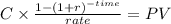

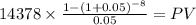

Present value of an annuity of $1 at 5% for 8 periods6.4632

Present value of an annuity of $1 at 7% for 8 periods5.9713

Enter the appropriate amounts in the designated cells. Enter all amounts as positive values. Round all amounts to the nearest whole number. If the amount is zero, enter a zero (0). Enter all percentages as a percentage, not a decimal.

For item 2, select the appropriate lease classification option by Company A from the option list provided.

Item

Amount

1. The discount rate for the lease used by Company A

2. Classification of the lease by Company A

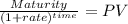

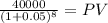

3. The amount at which the lease liability was recognized in Company A's financial statements at the lease commencement date

4. The amount of interest expense recognized by Company A in Year 1

5. The carrying amount of the right-of-use asset in Company A's December 31, Year 1, financial statements

6. The amount of Company A's lease liability on December 31, Year 1, after the first required payment was made

7. The amount of the current portion of the lease liability as it is presented in Company A's December 31, Year 1, financial statements

Answers: 1

Another question on Business

Business, 22.06.2019 09:50

For each of the following users of financial accounting information and managerial accounting information, specify whether the user would primarily use financial accounting information or managerial accounting information or both: 1. sec examiner 2. bookkeeping department 3. division controller 4. external auditor (public accounting firm) 5. loan officer at the company's bank 6. state tax agency auditor 7. board of directors 8. manager of the service department 9. wall street analyst 10. internal auditor 11. potential investors 12, current stockholders 13. reporter from the wall street journal 14. regional division managers

Answers: 1

Business, 22.06.2019 11:00

Using a cps-sample of 7,440 individuals, you estimate the following regression: = 20.91 - 2.61 x female where female is a binary variable that takes on the value of 1 for females and is 0 otherwise. the standard error on the coefficient on female is 0.25. the 95% confidence interval for the gender wage gap, or the amount that females earn less, is: a) [-3.10, -2.12] b) [18.30, 23.52] c) [-3.02, -2.20] d) [-1.96, -1.64]

Answers: 3

Business, 22.06.2019 12:20

Over the past decade, brands that were once available only to the wealthy have created more affordable product extensions, giving a far broader range of consumers a taste of the good life. jaguar, for instance, launched its x-type sedan, which starts at $30,000 and is meant for the "almost rich" consumer who aspires to live in luxury. by marketing to people who desire a luxurious lifestyle, jaguar is using:

Answers: 3

Business, 22.06.2019 12:20

Consider 8.5 percent swiss franc/u.s. dollar dual-currency bonds that pay $666.67 at maturity per sf1,000 of par value. it sells at par. what is the implicit sf/$ exchange rate at maturity? will the investor be better or worse off at maturity if the actual sf/$ exchange rate is sf1.35/$1.00

Answers: 2

You know the right answer?

On January 1, Year 1, Company A (the lessee) entered into an 8-year lease agreement with Company B (...

Questions

Physics, 12.01.2020 11:31

History, 12.01.2020 11:31

Biology, 12.01.2020 11:31

Mathematics, 12.01.2020 11:31

Mathematics, 12.01.2020 11:31

Mathematics, 12.01.2020 11:31

Mathematics, 12.01.2020 11:31