Business, 28.02.2021 17:40 Jerrikasmith28

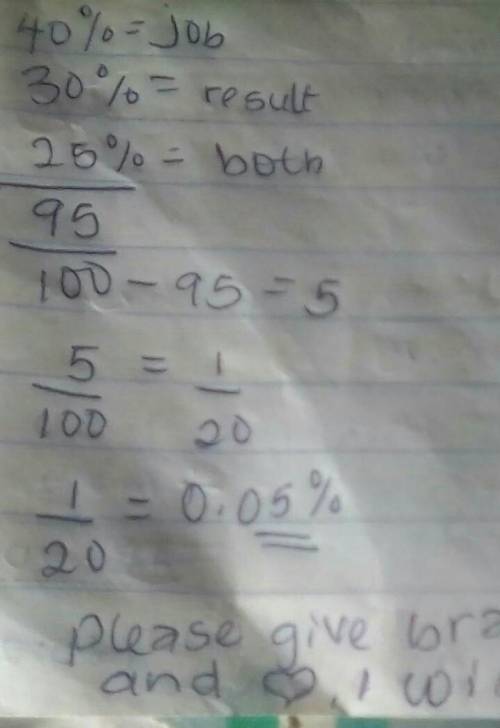

It was estimated that 40% of students were seriously worried about job prospects, 30% were thinking about their result and 25% were thinking about both. What is the probability that a randomly chosen student is seriously concerned about at least one of these two things?

Answers: 1

Another question on Business

Business, 22.06.2019 01:20

As a project manager for a large construction company, shaun decided to make the performance appraisal process as painless as possible for his crew. he spent a considerable amount of time creating performance standards he felt were reasonable, and after six months' time, he scheduled individual appointments with each worker to discuss strengths and weaknesses and areas that needed improvement according to the standards he privately set. some employees were sent to vestibule training, and one even got a promotion with additional compensation. what did he fail to do correctly

Answers: 2

Business, 22.06.2019 11:00

You decide to invest in a portfolio consisting of 25 percent stock a, 25 percent stock b, and the remainder in stock c. based on the following information, what is the expected return of your portfolio? state of economy probability of state return if state occurs of economy stock a stock b stock c recession .16 - 16.4 % - 2.7 % - 21.6 % normal .55 12.6 % 7.3 % 15.9 % boom .29 26.2 % 14.6 % 30.5 %

Answers: 1

Business, 23.06.2019 01:30

James jones is the owner of a small retail business operated as a sole proprietorship. during 2017, his business recorded the following items of income and expense: revenue from inventory sales $ 147,000 cost of goods sold 33,500 business license tax 2,400 rent on retail space 42,000 supplies 15,000 wages paid to employees 22,000 payroll taxes 1,700 utilities 3,600 compute taxable income attributable to the sole proprietorship by completing schedule c to be included in james’s 2017 form 1040. compute self-employment tax payable on the earnings of james’s sole proprietorship by completing a 2017 schedule se, form 1040. assume your answers to parts a and b are the same for 2018. further assume that james's business is not a service business, and that it has $155,000 unadjusted basis in tangible depreciable property. calculate james's 2018 section 199a deduction.

Answers: 1

Business, 23.06.2019 03:20

Name successful entrepreneurs from your area whose business is related to cookery

Answers: 1

You know the right answer?

It was estimated that 40% of students were seriously worried about job prospects, 30% were thinking...

Questions

Mathematics, 15.12.2020 06:10

English, 15.12.2020 06:10

Mathematics, 15.12.2020 06:10

Mathematics, 15.12.2020 06:10

Mathematics, 15.12.2020 06:10

History, 15.12.2020 06:10

Mathematics, 15.12.2020 06:10

Mathematics, 15.12.2020 06:10

Social Studies, 15.12.2020 06:10

Engineering, 15.12.2020 06:10

Mathematics, 15.12.2020 06:10

Mathematics, 15.12.2020 06:10

Biology, 15.12.2020 06:10

Engineering, 15.12.2020 06:10

Health, 15.12.2020 06:10