Business, 02.03.2021 04:50 whatsupp123

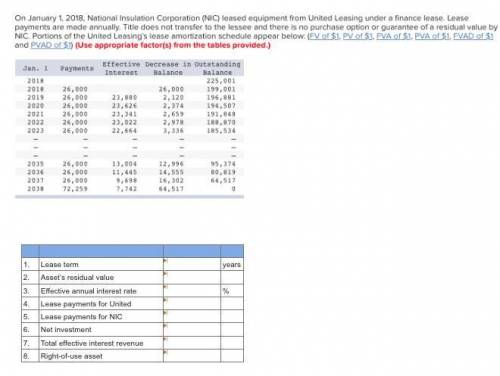

On january 1, 2018, national insulation corporation (nic) leased equipment from united leasing under a finance lease. lease payments are made annually. title does not transfer to the lessee and there is no purchase option or guarantee of a residual value by nic. portions of the united leasing's lease amortization schedule appear below: jan. 1 payments effective interest decrease in balance outstanding balance 2018 192,501 2018 20,000 20,000 172,501 2019 20,000 17,250 2,750 169,751 2020 20,000 16,975 3,025 166,726 2021 20,000 16,673 3,327 163,399 2022 20,000 16,340 3,660 159,739 2023 20,000 15,974 4,026 155,713 — — — — — — — — — — — — — — — 2035 20,000 7,364 12,636 61,006 2036 20,000 6,101 13,899 47,107 2037 20,000 4,711 15,289

Answers: 1

Another question on Business

Business, 22.06.2019 11:10

Suppose that the firm cherryblossom has an orchard they are willing to sell today. the net annual returns to the orchard are expected to be $50,000 per year for the next 20 years. at the end of 20 years, it is expected the land will sell for $30,000. calculate the market value of the orchard if the market rate of return on comparable investments is 16%.

Answers: 1

Business, 22.06.2019 20:00

A$100 million interest rate swap has a remaining life of 10 months. under the terms of the swap, the six-month libor is exchanged semi-annually for 12% per annum. the six-month libor rate in swaps of all maturities is currently 10% per annum with continuous compounding. the six-month libor rate was 9.6% per annum two months ago. what is the current value of the swap to the party paying floating? what is its value to the party paying fixed?

Answers: 2

Business, 22.06.2019 22:20

Which of the following events could increase the demand for labor? a. an increase in the marginal productivity of workers b. a decrease in the amount of capital available for workers to use c. a decrease in the wage paid to workers d. a decrease in output price

Answers: 1

Business, 23.06.2019 03:00

What is the w-4 form used for? filing taxes with the federal government determining the amount of money an employee has paid out in taxes calculating how much tax should be withheld from a person’s paycheck calculating how much income was paid in the previous year

Answers: 1

You know the right answer?

On january 1, 2018, national insulation corporation (nic) leased equipment from united leasing under...

Questions

Social Studies, 08.04.2021 17:00

Mathematics, 08.04.2021 17:00

Physics, 08.04.2021 17:00

Mathematics, 08.04.2021 17:00

Mathematics, 08.04.2021 17:00

Spanish, 08.04.2021 17:00

Mathematics, 08.04.2021 17:00

English, 08.04.2021 17:00

Mathematics, 08.04.2021 17:00

Biology, 08.04.2021 17:00

Mathematics, 08.04.2021 17:00

Mathematics, 08.04.2021 17:00

Mathematics, 08.04.2021 17:00

Mathematics, 08.04.2021 17:00

Mathematics, 08.04.2021 17:00