Business, 05.03.2021 04:20 MeowieMeowMeow6500

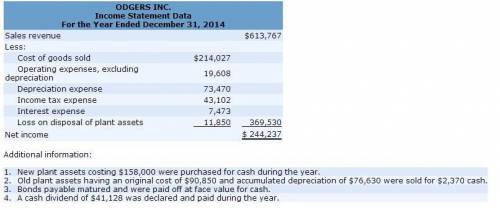

Additional information: 1. New plant assets costing $80,000 were purchased for cash during the year. 2. Old plant assets having an original cost of $46,000 and accumulated depreciation of $38,800 were sold for $1,200 cash. 3. Bonds payable matured and were paid off at face value for cash. 4. A cash dividend of $20,824 was declared and paid during the year. Further analysis reveals that accounts payable pertain to merchandise creditors. Prepare a statement of cash flows for Waterway Industries using the direct method.

Answers: 3

Another question on Business

Business, 22.06.2019 11:00

You decide to invest in a portfolio consisting of 25 percent stock a, 25 percent stock b, and the remainder in stock c. based on the following information, what is the expected return of your portfolio? state of economy probability of state return if state occurs of economy stock a stock b stock c recession .16 - 16.4 % - 2.7 % - 21.6 % normal .55 12.6 % 7.3 % 15.9 % boom .29 26.2 % 14.6 % 30.5 %

Answers: 1

Business, 22.06.2019 14:00

Your dormitory, griffingate, has appointed you central banker of its economy, which deals in the currency of wizcoins. assume that the velocity of wizcoins in griffingate is constant at 10,000 transactions per year. right now, real gdp is 1,000 wizcoins, and there are 2,000 wizcoins in existence.

Answers: 2

Business, 23.06.2019 03:20

You would like to compare your firm's cost structure to that of your competitors. however, your competitors are much larger in size than your firm. which one of these would best enable you to compare costs across your industry? common-size income statement. pro forma balance sheet. statement of cash flows. common-size balance sheet

Answers: 3

Business, 23.06.2019 05:10

To use google as main search engine, which internet browser can i use

Answers: 2

You know the right answer?

Additional information: 1. New plant assets costing $80,000 were purchased for cash during the year....

Questions

History, 22.06.2019 02:00

Biology, 22.06.2019 02:00

Physics, 22.06.2019 02:00

Biology, 22.06.2019 02:00

History, 22.06.2019 02:00

Health, 22.06.2019 02:00

Physics, 22.06.2019 02:00