Pepper Enterprises owns 95 percent of Salt Corporation. On January 1, 20X1, Salt issued $220,000 of five-year bonds at 115. Annual interest of 10 percent is paid semiannually on January 1 and July 1. Pepper purchased $120,000 of the bonds on August 31, 20X3, at par value. The following balances are taken from the separate 20X3 financial statements of the two companies: Note: Assume using straight-line amortization of bond discount or premium. Pepper Enterprises Salt Corporation Investment in Salt Corporation Bonds $ 125,700 Interest Income 4,367 Interest Receivable 6,000 Bonds Payable $ 220,000 Bond Premium 20,600 Interest Expense 15,400 Interest Payable 12,000

Required:

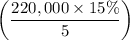

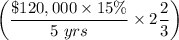

a. Compute the amount of interest expense that should be reported in the consolidated income statement for 20X3.

b. Compute the gain or loss on constructive bond retirement that should be reported in the 20X3 consolidated income statement.

c. Prepare the consolidation worksheet consolidation entry or entries as of December 31, 20X3, to remove the effects of the intercorporate bond ownership.

Answers: 1

Another question on Business

Business, 22.06.2019 01:00

How does the economy of cuba differ from the economy of north korea? in north korea, the government’s control of the economy has begun to loosen. in cuba, the government maintains a tight hold over the economy. in cuba, the government’s control of the economy has begun to loosen. in north korea, the government maintains a tight hold over the economy. in north korea, there is economic uncertainty in exchange for individual choice. in cuba, there is economic security in exchange for government control. in cuba, there is economic uncertainty in exchange for individual choice. in north korea, there is economic security in exchange for government control.\

Answers: 2

Business, 22.06.2019 13:20

Last year, johnson mills had annual revenue of $37,800, cost of goods sold of $23,200, and administrative expenses of $6,300. the firm paid $700 in dividends and had a tax rate of 35 percent. the firm added $2,810 to retained earnings. the firm had no long-term debt. what was the depreciation expense?

Answers: 2

Business, 22.06.2019 14:30

The face of a company is often that of the lowest paid employees who meet the customers. select one: true false

Answers: 1

Business, 22.06.2019 16:00

In microeconomics, the point at which supply and demand meet is called the blank price

Answers: 3

You know the right answer?

Pepper Enterprises owns 95 percent of Salt Corporation. On January 1, 20X1, Salt issued $220,000 of...

Questions

History, 09.12.2019 04:31

Mathematics, 09.12.2019 04:31

Mathematics, 09.12.2019 04:31

History, 09.12.2019 04:31

Geography, 09.12.2019 04:31

Social Studies, 09.12.2019 04:31

Mathematics, 09.12.2019 04:31

Mathematics, 09.12.2019 04:31

Biology, 09.12.2019 04:31

Biology, 09.12.2019 04:31

Physics, 09.12.2019 04:31