Business, 08.03.2021 03:10 zaniyastubbs9

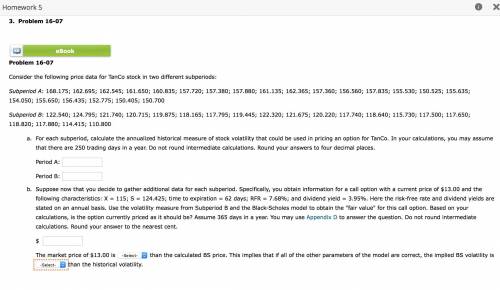

Consider the following price data for TanCo stock in two different subperiods:

Subperiod A: 168.175; 162.695; 162.545; 161.650; 160.835; 157.720; 157.380; 157.880; 161.135; 162.365; 157.360; 156.560; 157.835; 155.530; 150.525; 155.635; 154.050; 155.650; 156.435; 152.775; 150.405; 150.700

Subperiod B: 122.540; 124.795; 121.740; 120.715; 119.875; 118.165; 117.795; 119.445; 122.320; 121.675; 120.220; 117.740; 118.640; 115.730; 117.500; 117.650; 118.820; 117.880; 114.415; 110.800

For each subperiod, calculate the annualized historical measure of stock volatility that could be used in pricing an option for TanCo. In your calculations, you may assume that there are 250 trading days in a year. Do not round intermediate calculations. Round your answers to four decimal places.

Period A:

Period B:

b. Suppose now that you decide to gather additional data for each subperiod. Specifically, you obtain information for a call option with a current price of $13.00 and the following characteristics: X = 115; S = 124.425; time to expiration = 62 days; RFR = 7.68%; and dividend yield = 3.95%. Here the risk-free rate and dividend yields are stated on an annual basis. Use the volatility measure from Subperiod B and the Black-Scholes model to obtain the "fair value" for this call option. Based on your calculations, is the option currently priced as it should be? Assume 365 days in a year. You may use Appendix D to answer the question. Do not round intermediate calculations. Round your answer to the nearest cent.

$

The market price of $13.00 is (Higher/Lower) than the calculated BS price. This implies that if all of the other parameters of the model are correct, the implied BS volatility is (Higher/Lower) than the historical volatility.

Answers: 1

Another question on Business

Business, 21.06.2019 19:50

One investigating company tracked all credit card purchase during 2012 and measured two variables: (1) the type of credit card used (visa, mastercard, american express, or discover), and (2) the amount (in dollars) of each purchase. identify the level of each variable measured.

Answers: 1

Business, 22.06.2019 05:00

You are chairman of the board of a successful technology firm. there is a nominal federal corporate tax rate of 35 percent, yet the effective tax rate of the typical corporation is about 12.6%. your firm has been clever with use of transfer pricing and keeping money abroad and has barely paid any taxes over the last 5 years; during this same time period, profits were $28 billion. one member of the board feels that it is un-american to use various accounting strategies in order to avoid paying taxes. others feel that these are legal loopholes and corporations have a fiduciary responsibility to minimize taxes. one board member quoted what the ceo of exxon once said: “i’m not a u.s. company and i don’t make decisions based on what’s good for the u.s.” what are the alternatives? what are your recommendations? why do you recommend this course of action?

Answers: 2

Business, 22.06.2019 19:20

Although appealing to more refined tastes, art as a collectible has not always performed so profitably. during 2003, an auction house sold a sculpture at auction for a price of $10,211,500. unfortunately for the previous owner, he had purchased it in 2000 at a price of $12,177,500. what was his annual rate of return on this sculpture? (a negative answer should be indicated by a minus sign. do not round intermediate calculations and enter your answer as

Answers: 2

Business, 22.06.2019 22:00

Which of the following is the term for something that you can't live without 1. need 2. want 3. good 4. service

Answers: 1

You know the right answer?

Consider the following price data for TanCo stock in two different subperiods:

Subperiod A: 168.175...

Questions

Mathematics, 02.11.2020 19:00

English, 02.11.2020 19:00

Geography, 02.11.2020 19:00

Mathematics, 02.11.2020 19:00

English, 02.11.2020 19:00

Chemistry, 02.11.2020 19:00

Social Studies, 02.11.2020 19:00

Social Studies, 02.11.2020 19:00

English, 02.11.2020 19:00

Mathematics, 02.11.2020 19:00

Mathematics, 02.11.2020 19:00

Mathematics, 02.11.2020 19:00

Mathematics, 02.11.2020 19:00