Business, 08.03.2021 20:00 sherlyngaspar1p9t3ly

Mid-South Auto Leasing leases vehicles to consumers. The attraction to customers is that the company can offer competitive prices due to volume buying and requires an Interest rate Implicit In the lease that is one percent below alternate methods of financing. On September 30, 2018, the company leased a delivery truck to a local florist, Anything Grows.

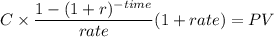

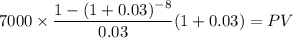

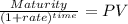

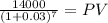

The lease agreement specified quarterly payments of $7,000 beginning September 30, 2018, the beginning of the lease, and each quarter (December 31, March 31, and June 30) through June 30, 2021 (three-year lease term). The florist had the option to purchase the truck on September 29, 2020, for $14,000 when It was expected to have a residual value of $14,000. The estimated useful life of the truck is four years. Mid-South Auto Leasing's quarterly interest rate for determining payments was 3% (approximately 12% annually). Mid-South paid $56,000 for the truck. Both companies use straight-line depreciation or amortization. Anything Grows' Incremental Interest rate is 12%. int: A leasing term ends for accounting purposes when an option becomes exercisable if It's expected to be exercised (L. e., a BPO). (FV of $1, PV of $1. FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1 (Use appropriate factor(s) from the tables provided.)

Required:

1. Calculate the amount of selling profit that Mid-South would recognize In this sales-type lease. (Be careful to note that, although payments occur on the last calendar day of each quarter since the first payment was at the beginning of the lease, payments represent an annuity due.)

2. Prepare the appropriate entries for Anything Grows and Mid-South on September 30, 2018.

3. Prepare an amortization schedule(s) describing the pattern of Interest expense for Anything Grows and Interest revenue for Mid- South Auto Leasing over the lease term.

4. Prepare the appropriate entries for Anything Grows and Mid-South Auto Leasing on December 31, 2018.

5. Prepare the appropriate entries for Anything Grows and Mid-South on September 29, 2020, assuming the purchase option was exercised on that date.

Answers: 1

Another question on Business

Business, 21.06.2019 20:40

On december 31, 2011, daggett company issued $750,000 of ten-year, 9% bonds payable for $700,353, yielding an effective interest rate of 10%. interest is payable semiannually on june 30 and december 31. prepare journal entries to reflect (a) the issuance of the bonds, (b) the semiannual interest payment and discount amortization (effective interest method) on june 30, 2012, and (c) the semiannual interest payment and discount amortization on december 31, 2012. round amounts to the nearest dollar.

Answers: 2

Business, 22.06.2019 07:50

The questions of economics address which of the following ? check all that apply

Answers: 3

Business, 22.06.2019 20:30

(30 total points) suppose a firm’s production function is given by q = l1/2*k1/2. the marginal product of labor and the marginal product of capital are given by: mpl = 1/ 2 1/ 2 2l k , and mpk = 1/ 2 1/ 2 2k l . a) (12 points) if the price of labor is w = 48, and the price of capital is r = 12, how much labor and capital should the firm hire in order to minimize the cost of production if the firm wants to produce output q = 18?

Answers: 1

Business, 22.06.2019 23:30

Rate of return douglas keel, a financial analyst for orange industries, wishes to estimate the rate of return for two similar-risk investments, x and y. douglas's research indicates that the immediate past returns will serve as reasonable estimates of future returns. a year earlier, investment x had a market value of $27 comma 000; and investment y had a market value of $46 comma 000. during the year, investment x generated cash flow of $2 comma 025 and investment y generated cash flow of $ 6 comma 770. the current market values of investments x and y are $28 comma 582 and $46 comma 000, respectively. a. calculate the expected rate of return on investments x and y using the most recent year's data. b. assuming that the two investments are equally risky, which one should douglas recommend? why?

Answers: 1

You know the right answer?

Mid-South Auto Leasing leases vehicles to consumers. The attraction to customers is that the company...

Questions

Mathematics, 13.04.2020 20:45

Mathematics, 13.04.2020 20:45

History, 13.04.2020 20:45

Mathematics, 13.04.2020 20:45

Mathematics, 13.04.2020 20:45

English, 13.04.2020 20:45

Mathematics, 13.04.2020 20:45

![\left[\begin{array}{cccccc}$Time&$Beg&$Cuota&$Interes&$Amort&$Ending\\0&61995.26&7000&&7000&54995.26\\1&54995.26&7000&1649.86&5350.14&49645.12\\2&49645.12&7000&1489.35&5510.65&44134.47\\3&44134.47&7000&1324.03&5675.97&38458.5\\4&38458.5&7000&1153.76&5846.24&32612.26\\5&32612.26&7000&978.37&6021.63&26590.63\\6&26590.63&7000&797.72&6202.28&20388.35\\7&20388.35&21000&611.65&20388.35&0\end{array}\right]](/tpl/images/1177/7088/d425f.png)