Business, 08.03.2021 20:00 davelopez979

Omni Advisors, an international pension fund manager, uses the concepts of purchasingpower parity (PPP) and uncovered interest parity/international Fisher effect (IFE) toforecast spot exchange rates. Omni gathers the financial information as follows:(Note: The rand (ZAR) is the South African currency. USD refers to the U. S. dollar. The base year denotes the beginning of the period.)

Base price level (any country) 100

Current U. S. price level 105

Current South African price level 111

Base rand spot exchange rate $0.175

Current rand spot exchange rate $0.158

Expected annual U. S. inflation 7%

Expected annual South African inflation 5%

Expected U. S. one-year interest rate 10%

Expected South African one-year interest rate 8%

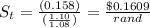

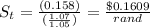

(a) According to PPP, what should the current ZAR spot rate in USD (USD/ZAR)be?

(b) According to PPP, is the U. S. dollar expected to appreciate or depreciate relativeto the rand over the year? Why?

(c) According to the UIP/IFE is the U. S. dollar expected to appreciate or depreciaterelative to the rand over the year? Why?

(d) Compare your answer in b) and c). Are you surprised? Why?

Answers: 3

Another question on Business

Business, 22.06.2019 03:30

Eagle sporting goods reported the following data at july ​31, 2016​, with amounts adapted in​ thousands: ​(click the icon to view the income​ statement.) ​(click the icon to view the statement of retained​ earnings.) ​(click the icon to view the balance​ sheet.) 1. compute eagle​'s net working capital. 2. compute eagle​'s current ratio. round to two decimal places. 3. compute eagle​'s debt ratio. round to two decimal places. do these values and ratios look​ strong, weak or​ middle-of-the-road? 1. compute eagle​'s net working capital. total current assets - total current liabilities = net working capital 99400 - 30000 = 69400 2. compute eagle​'s current ratio. ​(round answer to two decimal​ places.) total current assets / total current liabilities = current ratio 99400 / 30000 = 3.31 3. compute eagle​'s debt ratio. ​(round answer to two decimal​ places.) total liabilities / total assets = debt ratio 65000 / 130000 = 0.50 do these ratio values and ratios look​ strong, weak or​ middle-of-the-road? net working capital is ▾ . this means ▾ current assets exceed current liabilities current liabilities exceed current assets and is a ▾ negative positive sign. eagle​'s current ratio is considered ▾ middle-of-the-road. strong. weak. eagle​'s debt ratio is considered ▾ middle-of-the-road. strong. weak. choose from any list or enter any number in the input fields and then continue to the next question.

Answers: 3

Business, 22.06.2019 20:20

Which statement is not true about a peptide bond? which statement is not true about a peptide bond? the peptide bond has partial double-bond character. the carbonyl oxygen and the amide hydrogen are most often in a trans configuration with respect to one another. rotation is restricted about the peptide bond. the peptide bond is longer than the typical carbon-nitrogen bond.

Answers: 2

Business, 23.06.2019 01:30

Which of the following is considered part of a country’s infrastructure?

Answers: 1

You know the right answer?

Omni Advisors, an international pension fund manager, uses the concepts of purchasingpower parity (P...

Questions

Advanced Placement (AP), 14.02.2021 02:10

Social Studies, 14.02.2021 02:10

English, 14.02.2021 02:10

Social Studies, 14.02.2021 02:10

English, 14.02.2021 02:10

Mathematics, 14.02.2021 02:10

Biology, 14.02.2021 02:10

Physics, 14.02.2021 02:10

Mathematics, 14.02.2021 02:10

Mathematics, 14.02.2021 02:10

Spanish, 14.02.2021 02:10

Social Studies, 14.02.2021 02:10

Mathematics, 14.02.2021 02:10

English, 14.02.2021 02:10

whereas St will be the current level currencies,

whereas St will be the current level currencies,  was its base point currency.

was its base point currency.  would be in the home nation the market price

would be in the home nation the market price  in a different nation was its price standard.

in a different nation was its price standard.

= inflation rate in the home country

= inflation rate in the home country = inflation rate in a foreign country

= inflation rate in a foreign country

= Homeland interest rate

= Homeland interest rate = foreign country interest rate

= foreign country interest rate