Business, 08.03.2021 20:50 mustafajibawi1

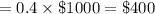

You are considering investing $1,000 in a T-bill that pays 0.05 and a risky portfolio, P, constructed with two risky securities, X and Y. The weights of X and Y in P are 0.60 and 0.40, respectively. X has an expected rate of return of 0.14 and variance of 0.01, and Y has an expected rate of return of 0.10 and a variance of 0.0081. What would be the dollar values of your positions in X and Y, respectively, if you decide to hold 40% of your money in the risky portfolio and 60% in T-bills

Answers: 2

Another question on Business

Business, 20.06.2019 18:04

True or false: the student with this role should never submit an asking price of less than $10.50.

Answers: 1

Business, 22.06.2019 04:30

How does your household gain from specialization and comparative advantage? (what is produced, what is not produced yet paid to a specialist to produce? )

Answers: 3

Business, 22.06.2019 16:30

On april 1, the cash account balance was $46,220. during april, cash receipts totaled $248,600 and the april 30 balance was $56,770. determine the cash payments made during april.

Answers: 1

You know the right answer?

You are considering investing $1,000 in a T-bill that pays 0.05 and a risky portfolio, P, constructe...

Questions

History, 22.11.2021 14:10

Mathematics, 22.11.2021 14:10

Computers and Technology, 22.11.2021 14:20

Social Studies, 22.11.2021 14:20

Mathematics, 22.11.2021 14:20

Mathematics, 22.11.2021 14:20

Computers and Technology, 22.11.2021 14:20

History, 22.11.2021 14:20

Mathematics, 22.11.2021 14:20

Mathematics, 22.11.2021 14:20

"

"

a risky portfolio

a risky portfolio

consist of x

consist of x