Spring Company issues $725,000 of 4%, four-year bonds dated January 1, 2015, that pay interest semiannually on June 30 and December 31. The market rate is 6% at the issue date. Bonds are sold a 94%

Break Company issues $900,000 of 10%, four-year bonds dated January 1, 2015, that pay interest semiannually on June 30 and December 31. The market rate is 6% at the issue date. Bonds are sold a 114%

Required for EACH company

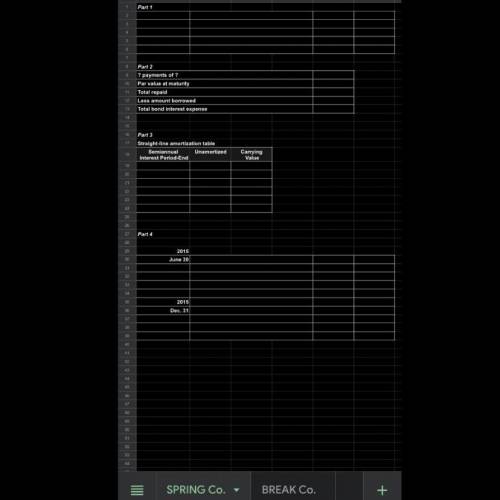

Prepare the January 1, 2015, journal entry to record the bonds' issuance.

Determine the total bond interest expense to be recognized over the bonds' life.

Prepare a straight-line amortization table for the bonds' first two years.

Prepare the journal entries to record the first two interest payments.

Answers: 2

Another question on Business

Business, 22.06.2019 00:00

Chance company had two operating divisions, one manufacturing farm equipment and the other office supplies. both divisions are considered separate components as defined by generally accepted accounting principles. the farm equipment component had been unprofitable, and on september 1, 2018, the company adopted a plan to sell the assets of the division. the actual sale was completed on december 15, 2018, at a price of $600,000. the book value of the division’s assets was $1,000,000, resulting in a before-tax loss of $400,000 on the sale. the division incurred a before-tax operating loss from operations of $130,000 from the beginning of the year through december 15. the income tax rate is 40%. chance’s after-tax income from its continuing operations is $350,000. required: prepare an income statement for 2018 beginning with income from continuing operations. include appropriate eps disclosures assuming that 100,000 shares of common stock were outstanding throughout the year. (amounts to be deducted should be indicated with a minus sign. round eps answers to 2 decimal places.)

Answers: 2

Business, 22.06.2019 06:30

If a seller prepaid the taxes of $4,400 and the closing is set for may 19, using the 12 month/30 day method what will the buyer owe the seller as prorated taxes?

Answers: 1

Business, 22.06.2019 20:40

Owns a machine that can produce two specialized products. production time for product tlx is two units per hour and for product mtv is four units per hour. the machine’s capacity is 2,100 hours per year. both products are sold to a single customer who has agreed to buy all of the company’s output up to a maximum of 3,570 units of product tlx and 1,610 units of product mtv. selling prices and variable costs per unit to produce the products follow. product tlx product mtv selling price per unit $ 11.50 $ 6.90 variable costs per unit 3.45 4.14 determine the company's most profitable sales mix and the contribution margin that results from that sales mix.

Answers: 3

Business, 22.06.2019 21:10

Acompany has two products: standard and deluxe. the company expects to produce 36,375 standard units and 62,240 deluxe units. it uses activity-based costing and has prepared the following analysis showing budgeted cost and cost driver activity for each of its three activity cost pools.budgeted activity of cost driver activity cost pool budgeted cost standard deluxe activity 1 $ 93,000 2,500 5,250 activity 2 $ 92,000 4,500 5,500 activity 3 $ 87,000 3,000 2,800 what is the overhead cost per unit for the standard units? what is the overhead cost per unit for the deluxe units? (round activity rate and cost per unit answers to 2 decimal places.)activity expected costs expected activity driver activity rate1 93,000 2 92,000 3 87,000 standard activity activity driver activity rate allocated costs1 2 3

Answers: 2

You know the right answer?

Spring Company issues $725,000 of 4%, four-year bonds dated January 1, 2015, that pay interest semia...

Questions

Mathematics, 23.11.2021 22:00

Mathematics, 23.11.2021 22:00

Social Studies, 23.11.2021 22:00

History, 23.11.2021 22:00

History, 23.11.2021 22:00

Social Studies, 23.11.2021 22:00

Mathematics, 23.11.2021 22:00

Computers and Technology, 23.11.2021 22:00

English, 23.11.2021 22:00

Mathematics, 23.11.2021 22:10