Business, 19.03.2021 23:10 zdejesus4994

Spring Company issues $725,000 of 4%, four-year bonds dated January 1, 2015, that pay interest semiannually on June 30 and December 31. The market rate is 6% at the issue date. Bonds are sold a 94%

Break Company issues $900,000 of 10%, four-year bonds dated January 1, 2015, that pay interest semiannually on June 30 and December 31. The market rate is 6% at the issue date. Bonds are sold a 114%

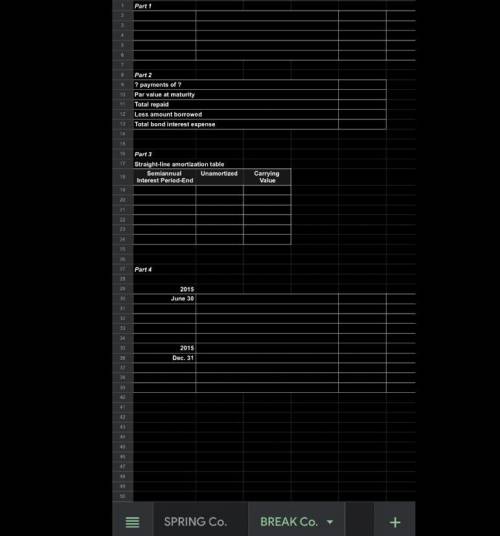

Required for EACH company

Prepare the January 1, 2015, journal entry to record the bonds' issuance.

Determine the total bond interest expense to be recognized over the bonds' life.

Prepare a straight-line amortization table for the bonds' first two years.

Prepare the journal entries to record the first two interest payments. m

Answers: 3

Another question on Business

Business, 22.06.2019 03:30

Joe finally found a house for sale that he liked. which factor could increase the price of the house he likes? a. both he and the seller each have a real estate agent. b. a home inspector finds faulty wiring in the house. c. the house has been for sale for almost a year. d. several buyers all want that same house.

Answers: 2

Business, 22.06.2019 11:30

Fred smithers, a recent college graduate decided to open his own portable juice bar, smithers smoothies, to wheel around newport beach. you, a trusted friend of fred, are a business major that has also recently graduated and agreed to handle the books for a while to get some practical experience and have a favor that you can ask of fred in the future. given the following five transactions concerning the new venture, prepare the necessary journal entries for the transactions, post the journal entries to appropriate t accounts and prepare a trial balance as of the end of the month in order to answer to the necessary may 2: fred invests $12,000 of his own money to start the new company. this money was obtained from a part-time job working at a legal firm while he was in school. may 3: fred spent $5,100 cash to purchase a refrigerated trailer that he can pull behind his car and set up at the beach. under your advice, fred agrees to place the new asset under an account called "equipment." may 6: fred bought $640 of supplies on account from the flav-o-rite confectioners company. because they will last longer than a single accounting period fred agrees to record them as, "supplies" as per your suggestion. may 13: fred sat on the beach for six hours without a single sale and was feeling very down. right before he left, however, a plumber escorting his family reunion along the beach stopped by his stand and bought $800 worth of smoothies for the entire family. under your advice, fred agrees to call this cash revenue, "sales." may 15: excited about his new venture, fred withdraws $350 from the company to take his girlfriend out to dinner. what would be the balance in the cash account at the end of the period following the posting of all the transactions?

Answers: 2

Business, 22.06.2019 13:30

Jose recently died with a probate estate of $900,000. he was predeceased by his wife, guadalupe, and his daughter, lucy. he has two surviving children, pete and fred. jose was also survived by eight grandchildren, pete’s three children, naomi, daniel, nick; fred’s three children, heather, chris and steve; and lucy’s two children, david and rachel. jose’s will states the following “i leave everything to my three children. if any of my children shall predecease me then i leave their share to their heirs, per stirpes.” which of the following statements is correct? (a) under jose’s will rachel will receive $150,000. (b) under jose’s will chris will receive $150,000. (c) under jose’s will nick will receive $100,000. (d) under jose’s will pete will receive $200,000.

Answers: 1

Business, 22.06.2019 20:20

Levine inc., which produces a single product, has prepared the following standard cost sheet for one unit of the product. direct materials (9 pounds at $1.80 per pound) $16.20 direct labor (6 hours at $14.00 per hour) $84.00 during the month of april, the company manufactures 270 units and incurs the following actual costs. direct materials purchased and used (2,500 pounds) $5,000 direct labor (1,660 hours) $22,908 compute the total, price, and quantity variances for materials and labor.

Answers: 2

You know the right answer?

Spring Company issues $725,000 of 4%, four-year bonds dated January 1, 2015, that pay interest semia...

Questions

English, 23.08.2019 22:00

Mathematics, 23.08.2019 22:00

Geography, 23.08.2019 22:00

Biology, 23.08.2019 22:00

History, 23.08.2019 22:00

English, 23.08.2019 22:00

Biology, 23.08.2019 22:00

Mathematics, 23.08.2019 22:00