. Has a high paying job and has determined he could afford up to $2500 per month

.

BRYCE:

. Has a high paying job and has determined he could afford up to $2500 per month

Wants a sweet home to reward all his hard work; his dream home costs $550,000

Has been sloppy in the past with his bill pay, leading to a credit score of 650, so the best rate he can get is

4.69% for 30 years

Is willing to contribute $50,000 to his down payment

11. How much, per month, is Bryce short on

mortgage payments for his dream home?

12. If he increased his down payment from $50,000 to $75,000, could Bryce get his monthly payments below

$2500?

a. Using this strategy, how much total interest would he pay over the course of the loan?

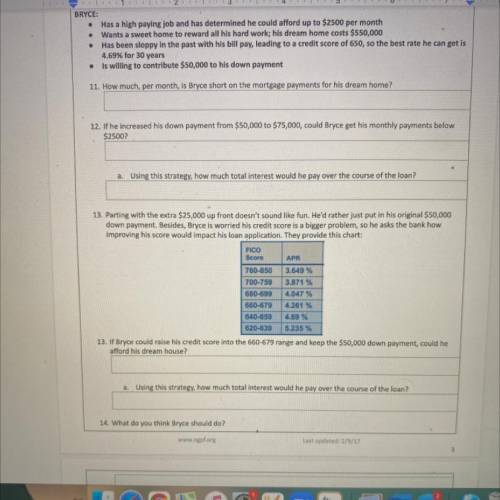

13. Parting with the extra $25,000 up front doesn't sound like fun. He'd rather just put in his original $50,000

down payment. Besides, Bryce is worried his credit score is a bigger problem, so he asks the bank how

improving his score would impact his loan application. They provide this chart:

FICO

Score APR

760-850 3.649 %

700-759 3.871 %

680-699 4.047 %

660-679 4.261 %

640-659 4.69%

620-639 5.235%

13. If Bryce could raise his Credit score into the 660 -679 range and keep the $50,000 down payment could he afford his dream house?

A. Using this Shatagee how much total interest would he pay over the course of the loan

14. what do you think I should do?

Answers: 3

Another question on Business

Business, 21.06.2019 23:30

On september 12, ryan company sold merchandise in the amount of $5,800 to johnson company, with credit terms of 2/10, n/30. the cost of the items sold is $4,000. ryan uses the periodic inventory system and the net method of accounting for sales. on september 14, johnson returns some of the non-defective merchandise, which is restored to inventory. the selling price of the returned merchandise is $500 and the cost of the merchandise returned is $350. the entry or entries that ryan must make on september 14 is (are): multiple choice sales returns and allowances 490 accounts receivable 490 merchandise inventory 350 cost of goods sold 350 sales returns and allowances 490 accounts receivable 490 sales returns and allowances 500 accounts receivable 500 sales returns and allowances 490 accounts receivable 490 merchandise inventory 343 cost of goods sold 343 sales returns and allowances 350 accounts receivable 350

Answers: 1

Business, 22.06.2019 06:40

10. which of the following is true regarding preretirement inflation? a. defined-benefit plans provide more inflation protection than defined-contribution plans. b. because of preretirement inflation, possible investment-related growth is increased for defined-contribution plans. c. all types of benefits are designed to cope with preretirement inflation. d. preretirement inflation is generally reflected in the increase in an employee's compensation level over a working career.

Answers: 3

Business, 22.06.2019 19:40

Your father's employer was just acquired, and he was given a severance payment of $375,000, which he invested at a 7.5% annual rate. he now plans to retire, and he wants to withdraw $35,000 at the end of each year, starting at the end of this year. how many years will it take to exhaust his funds, i.e., run the account down to zero? a. 22.50 b. 23.63 c. 24.81 d. 26.05 e. 27.35

Answers: 2

Business, 22.06.2019 22:30

Luggage world buys briefcases with an invoice date of september 28. the terms of sale are 2/10 eom. what is the net date for this invoice

Answers: 1

You know the right answer?

.

BRYCE:

. Has a high paying job and has determined he could afford up to $2500 per month

. Has a high paying job and has determined he could afford up to $2500 per month

Questions

English, 20.12.2019 18:31

Mathematics, 20.12.2019 18:31

English, 20.12.2019 18:31

Biology, 20.12.2019 18:31

English, 20.12.2019 18:31

Mathematics, 20.12.2019 18:31

Physics, 20.12.2019 18:31

History, 20.12.2019 18:31

Social Studies, 20.12.2019 18:31

History, 20.12.2019 18:31

Physics, 20.12.2019 18:31

Mathematics, 20.12.2019 18:31