Business, 23.03.2021 03:00 meaddestinee

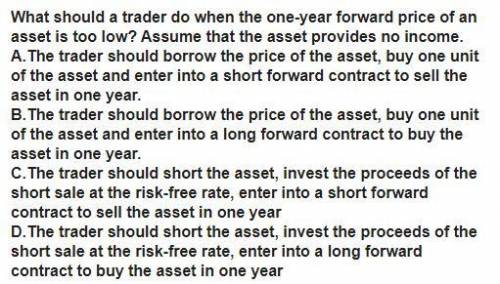

What should a trader do when the one-year forward price of an asset is too low? Assume that the asset provides no income. The trader should borrow the price of the asset, buy one unit of the asset and enter into a long forward contract to buy the asset in one year. The trader should borrow the price of the asset, buy one unit of the asset and enter into a short forward contract to sell the asset in one year. The trader should short the asset, invest the proceeds of the short sale at the risk-free rate, enter into a short forward contract to sell the asset in one year The trader should short the asset, invest the proceeds of the short sale at the risk-free rate, enter into a long forward contract to buy the asset in one year

Answers: 2

Another question on Business

Business, 22.06.2019 11:20

Which stage of group development involves members introducing themselves to each other?

Answers: 3

Business, 22.06.2019 19:50

What is the present value of the following cash flow stream at a rate of 12.0%? years: 0 1 2 3 4| | | | |cfs: $0 $1,500 $3,000 $4,500 $6,000a. $9,699b. $10,210c. $10,747d. $11,284e. $11,849

Answers: 3

Business, 23.06.2019 00:20

According to the naeyc curriculum is effective when all of the following occur except

Answers: 2

Business, 23.06.2019 01:40

The petty cash fund has a current balance of $ 350, which is the established fund balance. based on activity in the fund, it is determined that the balance needs to be changed to $ 450. which journal entry is needed to make this change?

Answers: 3

You know the right answer?

What should a trader do when the one-year forward price of an asset is too low? Assume that the asse...

Questions

Mathematics, 12.12.2020 16:50

History, 12.12.2020 16:50

Mathematics, 12.12.2020 16:50

Medicine, 12.12.2020 16:50

Mathematics, 12.12.2020 16:50

History, 12.12.2020 16:50

Mathematics, 12.12.2020 16:50

Mathematics, 12.12.2020 16:50

Mathematics, 12.12.2020 16:50

Computers and Technology, 12.12.2020 16:50

Physics, 12.12.2020 16:50

Spanish, 12.12.2020 16:50

Mathematics, 12.12.2020 16:50