Business, 26.03.2021 20:50 annekesimonsen

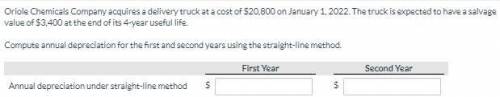

Oriole Chemicals Company acquires a delivery truck at a cost of $20,800 on January 1, 2022. The truck is expected to have a salvage value of $3,400 at the end of its 4-year useful life. Compute annual depreciation for the first and second years using the straight-line method.

Answers: 1

Another question on Business

Business, 21.06.2019 15:30

Josie, an unmarried taxpayer, has $155,000 in salary, $10,000 in income from a passive investment in a limited partnership, and a $26,000 passive loss from a real estate rental activity in which she actively participates. if her modified adjusted gross income is $155,000, how much of the $26,000 loss is deductible

Answers: 1

Business, 21.06.2019 19:30

What preforms the best over the long term? a) bonds b) mutual funds c) stocks d) certificate of deposit

Answers: 2

Business, 21.06.2019 23:30

The uno company was formed on january 2, year 1, to sell a single product. over a 2-year period, uno’s acquisition costs have increased steadily. physical quantities held in inventory were equal to 3 months’ sales at december 31, year 1, and zero at december 31, year 2. assuming the periodic inventory system, the inventory cost method which reports the highest amount for each of the following is inventory december 31, year 1/ cost of sales year 2 a: lifo fifo b: lifo lifo c: fifo fifo d: fifo lifo

Answers: 3

You know the right answer?

Oriole Chemicals Company acquires a delivery truck at a cost of $20,800 on January 1, 2022. The truc...

Questions

Mathematics, 05.06.2021 04:50

Mathematics, 05.06.2021 04:50

Mathematics, 05.06.2021 04:50

Mathematics, 05.06.2021 04:50

Mathematics, 05.06.2021 04:50

History, 05.06.2021 04:50

Arts, 05.06.2021 04:50

Mathematics, 05.06.2021 04:50

Mathematics, 05.06.2021 04:50

Mathematics, 05.06.2021 04:50

Mathematics, 05.06.2021 04:50

Mathematics, 05.06.2021 04:50