Business, 02.04.2021 20:30 alazayjaime1423

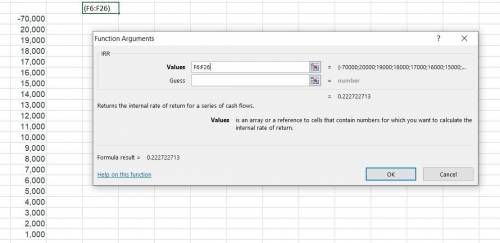

Nu Things, Inc., is considering investing in a business venture with the following anticipated cash flow results:

EOY Cash Flow

0 -$70,000

1 $20,000

2 $19,000

3 $18,000

4 $17,000

5 $16,000

6 $15,000

7 $14,000

8 $13,000

9 $12,000

10 $11,000

11 $10,000

12 $9,000

13 $8,000

14 $7,000

15 $6,000

16 $5,000

17 $4,000

18 $3,000

19 $2,000

20 $1,000

Assume MARR is 20 percent per year. Based on an internal rate of return analysis:

Determine the investment.

Answers: 2

Another question on Business

Business, 22.06.2019 02:20

The following information is available for jase company: market price per share of common stock $25.00 earnings per share on common stock $1.25 which of the following statements is correct? a. the price-earnings ratio is 20 and a share of common stock was selling for 20 times the amount of earnings per share at the end of the year. b. the market price per share and the earnings per share are not statistically related to each other. c. the price-earnings ratio is 5% and a share of common stock was selling for 5% more than the amount of earnings per share at the end of the year. d. the price-earnings ratio is 10 and a share of common stock was selling for 125 times the amount of earnings per share at the end of the year.

Answers: 1

Business, 22.06.2019 03:30

Sarah salesrep is brand new to her job selling "lifetime" printers that never need replacement ink cartridges. the problem is that these printers cost ten times more than a regular printer, so it is difficult to get prospective buyers to understand the cost savings of buying it. to break through the barrier and begin making sales, sarah should use a analysis that highlights her printer's lower cost.

Answers: 3

Business, 22.06.2019 05:50

Emily spent her summer vacation in buenos aires, argentina, where she got plastic surgery for a fraction of what it would cost in the united states. this is an example of:

Answers: 2

Business, 22.06.2019 19:00

Consider the following information on stocks a, b, c and their returns (in decimals) in each state: state prob. of state a b c boom 20% 0.27 0.22 0.16 good 45% 0.16 0.09 0.07 poor 25% 0.03 0 0.03 bust 10% -0.08 -0.04 -0.02 if your portfolio is invested 25% in a, 40% in b, and 35% in c, what is the standard deviation of the portfolio in percent? answer to two decimals, carry intermediate calcs. to at least four decimals.

Answers: 2

You know the right answer?

Nu Things, Inc., is considering investing in a business venture with the following anticipated cash...

Questions

Spanish, 18.02.2021 17:00

Mathematics, 18.02.2021 17:00

History, 18.02.2021 17:00

Mathematics, 18.02.2021 17:00

Mathematics, 18.02.2021 17:00

Social Studies, 18.02.2021 17:00

English, 18.02.2021 17:00

Physics, 18.02.2021 17:00

Mathematics, 18.02.2021 17:00

Health, 18.02.2021 17:00

Mathematics, 18.02.2021 17:00