Business, 07.04.2021 03:40 shaylasimonds6103

Fabricating and Finishing are two production departments of Michael Manufacturing. Building Operations and Information Services are support departments. “Building Operations” provides services to both support and production departments. YOU ARE THE MANAGER OF THE FABRICATING DEPARTMENT!

“Information Services” does NOT provide any services for non-production areas of the company.

The company employs departmental overhead rates and both producing departments use machine hours to allocate their overhead. Square footage is used to allocate building operations, while computer time is used to allocate information services.

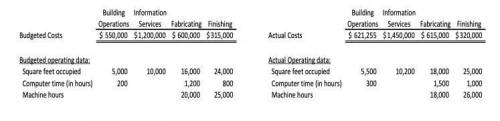

The budgeted and actual cost data of the support departments, departmental overhead and other relevant operating data are as follows:

1. The company is using the Direct Method to allocate support costs. Under this method, how much Building Operations cost will be allocated to Information Services?

2. Michael mentions to Paul that they could really benefit from using the most accurate method, known as the "Reciprocal" or "Algebraic" method. Could Michael benefit from using this method? Yes or No and WHY?

3. Liza suggests that the Step Method be used. Under this method, what will be the POHR that will be used in your Fabricating department for product costing during the year (per machine hour)?

4. Your Building Operations department is a cost center. Thus, at the end of the year you will receive a responsibility-accounting based report comparing your budgeted direct costs and support costs and comparing these to the actual.

5. Based on your computations above, how much total cost will your Building Operations department be held accountable for (charged with) for performance evaluation purposes?

Answers: 3

Another question on Business

Business, 21.06.2019 19:40

Alocation analysis has been narrowed down to two locations, akron and boston. the main factors in the decision will be the supply of raw materials, which has a weight of .50, transportation cost, which has a weight of .40, and labor cost, which has a weight of .10. the scores for raw materials, transportation, and labor are for akron 60, 80, and 70, respectively; for boston 70, 50, and 90, respectively. given this information and a minimum acceptable composite score of 75, we can say that the manager should:

Answers: 3

Business, 22.06.2019 09:40

Newton industries is considering a project and has developed the following estimates: unit sales = 4,800, price per unit = $67, variable cost per unit = $42, annual fixed costs = $11,900. the depreciation is $14,700 a year and the tax rate is 34 percent. what effect would an increase of $1 in the selling price have on the operating cash flow?

Answers: 2

Business, 22.06.2019 20:50

Lead time for one of your fastest-moving products is 20 days. demand during this period averages 90 units per day.a) what would be an appropriate reorder point? ) how does your answer change if demand during lead time doubles? ) how does your answer change if demand during lead time drops in half?

Answers: 1

Business, 22.06.2019 22:50

For 2016, gourmet kitchen products reported $22 million of sales and $19 million of operating costs (including depreciation). the company has $15 million of total invested capital. its after-tax cost of capital is 10%, and its federal-plus-state income tax rate was 36%. what was the firm’s economic value added (eva), that is, how much value did management add to stockholders’ wealth during 2016?

Answers: 1

You know the right answer?

Fabricating and Finishing are two production departments of Michael Manufacturing. Building Operatio...

Questions

Mathematics, 17.02.2021 21:30

Mathematics, 17.02.2021 21:30

English, 17.02.2021 21:30

Mathematics, 17.02.2021 21:30

Mathematics, 17.02.2021 21:30

Mathematics, 17.02.2021 21:30

Advanced Placement (AP), 17.02.2021 21:30

Mathematics, 17.02.2021 21:30

Mathematics, 17.02.2021 21:30

Mathematics, 17.02.2021 21:30

Mathematics, 17.02.2021 21:30