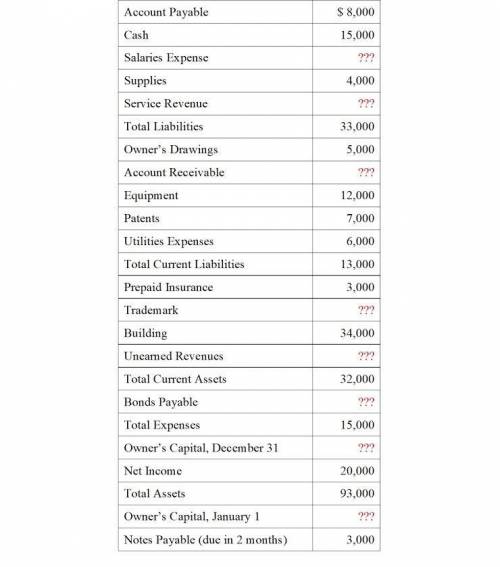

Total Liabilities and Owner’s Equity value is: *

$45,000

$60,000

$93,000

None of...

Business, 09.04.2021 14:00 Kjcampbell2

Total Liabilities and Owner’s Equity value is: *

$45,000

$60,000

$93,000

None of the above

The Salaries expense value is: *

$6,000

$9,000

$15,000

None of the above

The Service Revenue Value is: *

$9,000

$15,000

$35,000

None of the above

The Account Receivable value is: *

$10,000

$13,000

$17,000

None of the above

Total Property, Plant & Equipment value is: *

$12,000

$34,000

$46,000

None of the above

Trademark value is: *

$8,000

$15,000

$20,000

None of the above

Unearned Revenues value is: *

$8,000

$13,000

$25,000

None of the above

Bonds Payable value is: *

$13,000

$20,000

$33,000

None of the above

Owner’s Capital on December 31 value is: *

$33,000

$45,000

$60,000

None of the above

Owner’s Capital on January 1 value is: *

$40,000

$45,000

$60,000

None of the above

Answers: 3

Another question on Business

Business, 22.06.2019 02:30

Acompany using the perpetual inventory system purchased inventory worth $540,000 on account with credit terms of 2/15, n/45. defective inventory of $40,000 was returned 2 days later, and the accounts were appropriately adjusted. if the company paid the invoice 20 days later, the journal entry to record the payment would be

Answers: 1

Business, 22.06.2019 04:30

Required prepare the necessary adjusting entries in the general journal as of december 31, assuming the following: on september 1, the company entered into a prepaid equipment maintenance contract. birch company paid $3,400 to cover maintenance service for six months, beginning september 1. the payment was debited to prepaid maintenance. supplies on hand at december 31 are $3,900. unearned commission fees at december 31 are $7,000. commission fees earned but not yet billed at december 31 are $3,500. (note: debit fees receivable.) birch company's lease calls for rent of $1,600 per month payable on the first of each month, plus an annual amount equal to 1% of annual commissions earned. this additional rent is payable on january 10 of the following year. (note: be sure to use the adjusted amount of commissions earned in computing the additional rent.)

Answers: 1

Business, 22.06.2019 22:00

What legislation increased the ability for federal authorities to tap telephones and wireless devices, tightened the enforcement of money laundering activities, as well as broadened powers toward acts of terrorism and acts such as drug trafficking?

Answers: 2

You know the right answer?

Questions

Mathematics, 09.10.2019 10:30

English, 09.10.2019 10:30

Biology, 09.10.2019 10:30

Chemistry, 09.10.2019 10:30

Mathematics, 09.10.2019 10:30

Geography, 09.10.2019 10:30

History, 09.10.2019 10:30

Social Studies, 09.10.2019 10:30

Physics, 09.10.2019 10:30

History, 09.10.2019 10:30