Business, 13.04.2021 05:00 fdougie111

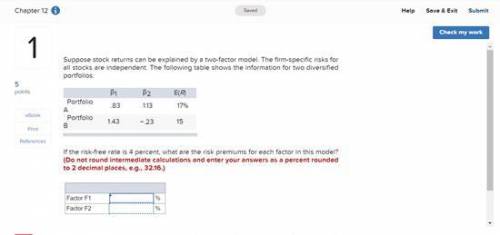

Suppose stock returns can be explained by a two-factor model. The firm-specific risks for all stocks are independent. The following table shows the information for two diversified portfolios:

β1 β2 E(R)

Portfolio A .83 1.13 17%

Portfolio B 1.43 −.23 15

If the risk-free rate is 4 percent, what are the risk premiums for each factor in this model? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e. g., 32.16.)

Looking for:

Factor F1 = _%

Factor F2 = _%

Answers: 1

Another question on Business

Business, 22.06.2019 19:40

Chang corp. has $375,000 of assets, and it uses only common equity capital (zero debt). its sales for the last year were $595,000, and its net income was $25,000. stockholders recently voted in a new management team that has promised to lower costs and get the return on equity up to 15.0%. what profit margin would the firm need in order to achieve the 15% roe, holding everything else constant? a. 9.45%b. 9.93%c. 10.42%d. 10.94%e. 11.49%

Answers: 2

Business, 22.06.2019 21:50

Which three of the following expenses can student aid recover? -tuition -television -school supplies -parties and socializing -boarding/housing

Answers: 2

Business, 23.06.2019 00:00

How did the change in textile production affect employment in spinning and weaving for adults and children?

Answers: 1

Business, 23.06.2019 18:10

In milton friedman's social responsibility of business is to increase its profits, what analogy does dr. friedman draw between trade union wages and corporations' decisions based on social responsibilities?

Answers: 3

You know the right answer?

Suppose stock returns can be explained by a two-factor model. The firm-specific risks for all stocks...

Questions

English, 23.09.2019 13:30

Mathematics, 23.09.2019 13:30

Mathematics, 23.09.2019 13:30

Biology, 23.09.2019 13:30

Mathematics, 23.09.2019 13:30

History, 23.09.2019 13:30

Social Studies, 23.09.2019 13:30

Biology, 23.09.2019 13:30