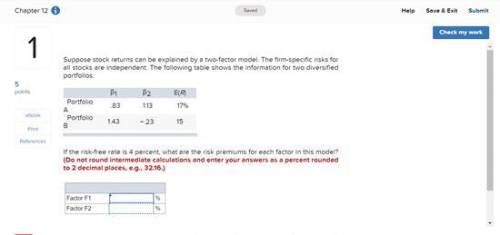

Β1 β2 E(R)

Portfolio A .83 1.13 17%

Portfolio B 1.43 −.23 15

If the risk-free rat...

Business, 14.04.2021 04:40 bihanna1234

Β1 β2 E(R)

Portfolio A .83 1.13 17%

Portfolio B 1.43 −.23 15

If the risk-free rate is 4 percent, what are the risk premiums for each factor in this model? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e. g., 32.16.)

Looking for:

Factor F1 = _%

Factor F2 = _%

Answers: 3

Another question on Business

Business, 22.06.2019 01:30

Monica needs to assess the slide sequence and make quick changes to it. which view should she use in her presentation program? a. outline b. slide show c. slide sorter d. notes page e. handout

Answers: 1

Business, 22.06.2019 17:40

Within the relevant range, if there is a change in the level of the cost driver, then a. total fixed costs will remain the same and total variable costs will change b. total fixed costs will change and total variable costs will remain the same c. total fixed costs and total variable costs will change d. total fixed costs and total variable costs will remain the same

Answers: 3

Business, 22.06.2019 18:00

During the holiday season, maria's department store works with a contracted employment agency to bring extra workers on board to handle overflow business, and extra duties such as wrapping presents. maria's is using during these rush times.

Answers: 3

Business, 22.06.2019 18:00

David paid $975,000 for two beachfront lots in coastal south carolina, with the intention of building residential homes on each. two years later, the south carolina legislature passed the beachfront management act, barring any further development of the coast, including david's lots. when david files a complaint to seek compensation for his property, south carolina refuses, pointing to a passage in david's own complaint that states "the beachfront management act [was] properly and validly designed to south carolina's " is south carolina required to compensate david under the takings clause?

Answers: 1

You know the right answer?

Questions

History, 21.06.2019 16:20

Mathematics, 21.06.2019 16:20

Mathematics, 21.06.2019 16:20

Mathematics, 21.06.2019 16:20