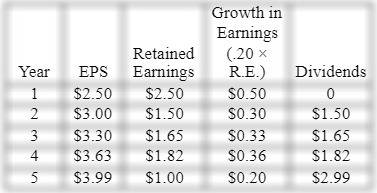

Rearden metals expects to have earnings this coming year of $2.50 per share. rearden plans to retain all of its earnings for the next year. for the subsequent three years, the firm will retain 50% of its earnings. it will ten retain 25% of its earnings from that point onward. each year, retained earnings will be invested in new projects with an expected return of 20% per year. any earnings that are not retained will be paid out as dividends. assume rearden's shares outstanding remains constant and all earnings growth comes from the investment of retained earnings. if rearden's equity cost of capital is 10%, then rearden's stock price is closest to:

Answers: 1

Another question on Business

Business, 23.06.2019 00:50

Mr. drucker uses a periodic review system to manage the inventory in his dry goods store. he likes to maintain 15 sacks of sugar on his shelves based on the annual demand figure of 225 sacks. it costs $2 to place an order for sugar and costs $1 to hold a sack in inventory for a year. mr. drucker checks inventory one day and notes that he is down to 9 sacks; how much should he order?

Answers: 1

Business, 23.06.2019 03:00

What are the weak points of economic costs that are part of a free enterprise economy?

Answers: 1

Business, 23.06.2019 08:30

In the supply-and-demand schedule shown above, the equilibrium price for cell phones is $25 $100 $200

Answers: 2

Business, 23.06.2019 10:00

When the amount paid for land is $36,000 and the amount paid for expenses is $10,000, the balance in total assets after transaction (b) is

Answers: 1

You know the right answer?

Rearden metals expects to have earnings this coming year of $2.50 per share. rearden plans to retain...

Questions

Mathematics, 26.05.2021 14:00

English, 26.05.2021 14:00

Mathematics, 26.05.2021 14:00

Mathematics, 26.05.2021 14:00

Computers and Technology, 26.05.2021 14:00

English, 26.05.2021 14:00

Mathematics, 26.05.2021 14:00

History, 26.05.2021 14:00

History, 26.05.2021 14:00

Mathematics, 26.05.2021 14:00

Biology, 26.05.2021 14:00