Business, 12.05.2021 04:50 rakanmadi87

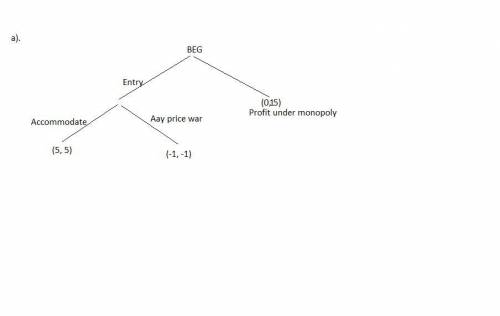

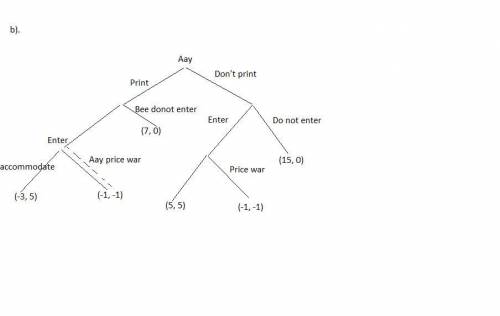

Firm Aay operates a pool hall in Boom Town. Business has been very profitable. However, there are dark clouds on the horizon. Firm Bee is considering entering the pool hall market in Boom Town. The profits of Aay are 15 if it is a monopoly; if Bee enters and Aay accommodates and shares the market the duopoly profits are 5 for each firm; is Bee enters and Aay launches a price war, both firms earn -1.

a) Draw the game tree for this scenario and determine the subgame perfect equilibrium (SPE).

b) What if launching a price war involves not only charging a low price, but printing flyers to inform the public of the great deals available? If there is a price war, both firms print flyers, and the net result of the price war is -1 for each firm (that is, the -1 takes into account the cost of printing the flyers.) Assume that Aay can have flyers printed up prior to Bee's entry decision and that the printing cost is $8. Draw the game tree for this scenario and determine the subgame perfect equilibrium.

c) What does your answer to (b) imply about the relationship between sunk costs, firstmover advantages, and entry deterrence? plz type down u answer

Answers: 2

Another question on Business

Business, 22.06.2019 11:10

Robert black, regional manager for ford in texas and oklahoma, faced a dilemma. the ford f-150 pickup truck was the best-selling pickup ever, yet ford's headquarters in detroit had decided to introduce a completely redesigned f-150. how could mr. black sell both trucks at the same time? he still had "old" f-150s in stock. in his advertising, mr. black referred to the new f-150s as follows: "not a better f-150. just the only truck good enough to be the next f-150." this statement represents ford's of the new f-150.

Answers: 2

Business, 22.06.2019 19:10

The stock of grommet corporation, a u.s. company, is publicly traded, with no single shareholder owning more than 5 percent of its outstanding stock. grommet owns 95 percent of the outstanding stock of staple inc., also a u.s. company. staple owns 100 percent of the outstanding stock of clip corporation, a canadian company. grommet and clip each own 50 percent of the outstanding stock of fastener inc., a u.s. company. grommet and staple each own 50 percent of the outstanding stock of binder corporation, a u.s. company. which of these corporations form an affiliated group eligible to file a consolidated tax return?

Answers: 3

Business, 23.06.2019 01:00

Ido not understand this project overview agricultural commodities are bought and sold through the stock exchange. the price of commodities changes all the time. investors buy many agricultural commodities before they are ready for shipping. when an investor buys an agricultural commodity that is going to be ready in the future, they call this purchasing futures. this might be a future crop, meat that has not yet been processed, or another type of agricultural commodity. for this project, you will have to decide how to spend $10,000. research the new york stock exchange. find one or more agricultural commodities that you are interested in. remember, it may be listed as a future crop. instructions identify the agricultural commodities that you think have the best chance of going up in price. think about what is going on with supply and demand. decide how you will spend your money. you may purchase only agricultural commodities. check the market every day for a week. record the price of your commodity or commodities each day. you may buy or sell your commodities at any time during the week. you may sell your commodities and buy different ones. feel free to experiment with the $10,000 by buying and selling commodities, but make sure to keep a careful record of your activities. at the end of the week, you will write a report on your investments. this report should be structured to include this information: page 1: explain how the stock market works. page 2: list all commodities purchased. describe each in detail. discuss why you selected these commodities. remember, they must be agricultural. page 3: create a chart or graph to illustrate the price of your commodity or commodities over the week’s time. list all of your activity buying and selling. make sure you include prices and details. page 4: write a summary of your experience. describe what you might do differently if you were using actual money. propose potential reasons why the price of each commodity may go up or down.

Answers: 1

Business, 23.06.2019 05:20

What is difference between fiscal year and tax year? explain in the simplest way.

Answers: 1

You know the right answer?

Firm Aay operates a pool hall in Boom Town. Business has been very profitable. However, there are da...

Questions

Social Studies, 07.10.2019 13:10

Mathematics, 07.10.2019 13:10

History, 07.10.2019 13:10

Biology, 07.10.2019 13:10

Geography, 07.10.2019 13:10

Chemistry, 07.10.2019 13:10

History, 07.10.2019 13:10

Mathematics, 07.10.2019 13:10

Mathematics, 07.10.2019 13:10

English, 07.10.2019 13:10

Business, 07.10.2019 13:10