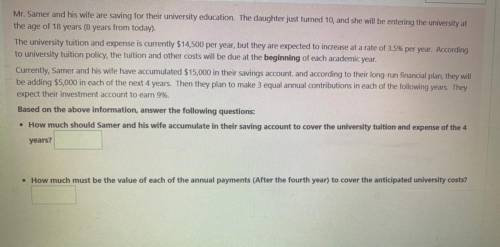

Mr. Samer and his wife are saving for their university education. The daughter just turned 10, and she will be entering the university at

the age of 18 years (8 years from today).

The university tuition and expense is currently $14,500 per year, but they are expected to increase at a rate of 3.5% per year. According

to university tuition policy, the tuition and other costs will be due at the beginning of each academic year.

Currently, Samer and his wife have accumulated $15,000 in their savings account and according to their long-run financial plan, they will

be adding $5,000 in each of the next 4 years. Then they plan to make 3 equal annual contributions in each of the following years. They

expect their investment account to earn 9%.

Based on the above information, answer the following questions:

• How much should Samer and his wife accumulate in their saving account to cover the university tuition and expense of the 4

years?

• How much must be the value of each of the annual payments (After the fourth year) to cover the anticipated university costs?

Answers: 1

Another question on Business

Business, 22.06.2019 04:30

4. the condition requires that only one of the selected criteria be true for a record to be displayed.

Answers: 1

Business, 22.06.2019 08:00

Lavage rapide is a canadian company that owns and operates a large automatic car wash facility near montreal. the following table provides data concerning the company’s costs: fixed cost per month cost per car washed cleaning supplies $ 0.70 electricity $ 1,400 $ 0.07 maintenance $ 0.15 wages and salaries $ 4,900 $ 0.30 depreciation $ 8,300 rent $ 1,900 administrative expenses $ 1,400 $ 0.03 for example, electricity costs are $1,400 per month plus $0.07 per car washed. the company expects to wash 8,000 cars in august and to collect an average of $6.50 per car washed. the actual operating results for august appear below. lavage rapide income statement for the month ended august 31 actual cars washed 8,100 revenue $ 54,100 expenses: cleaning supplies 6,100 electricity 1,930 maintenance 1,440 wages and salaries 7,660 depreciation 8,300 rent 2,100 administrative expenses 1,540 total expense 29,070 net operating income $ 25,030 required: calculate the company's revenue and spending variances for august.

Answers: 3

Business, 22.06.2019 15:30

On january 15, the end of the first biweekly pay period of the year, north company’s payroll register showed that its employees earned $32,000 of sales salaries. withholdings from the employees’ salaries include fica social security taxes at the rate of 6.2%, fica medicare taxes at the rate of 1.45%, $3,000 of federal income taxes, $772 of medical insurance deductions, and $260 of union dues. no employee earned > $7,000 in this first period. prepare the journal entry to record north company’s january 15 (employee) payroll expenses and liabilities.

Answers: 3

Business, 22.06.2019 15:40

Acompany manufactures x units of product a and y units of product b, on two machines, i and ii. it has been determined that the company will realize a profit of $3 on each unit of product a and $4 on each unit of product b. to manufacture a unit of product a requires 7 min on machine i and 5 min on machine ii. to manufacture a unit of product b requires 8 min on mchine i and 5 min on machine ii. there are 175 min available on machine i and 125 min available on machine ii in each work shift. how many units of a product should be produced in each shift to maximize the company's profit p?

Answers: 2

You know the right answer?

Mr. Samer and his wife are saving for their university education. The daughter just turned 10, and s...

Questions

Social Studies, 04.12.2020 17:00

Mathematics, 04.12.2020 17:00

Mathematics, 04.12.2020 17:00