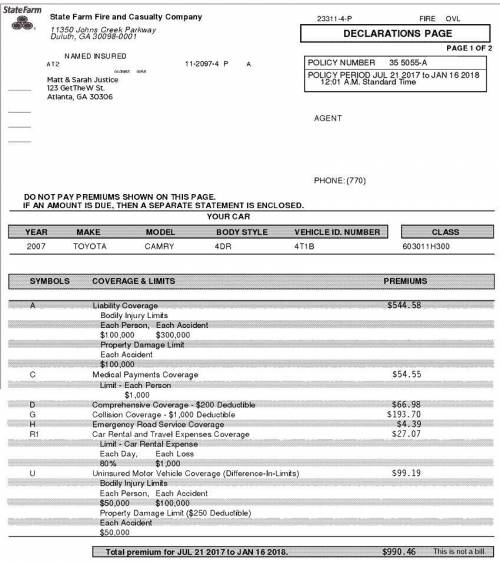

Analyze the auto insurance declaration page and answer the questions.

What insurance company is providing this coverage, and who is the policy holder(s)?

Question 1 options:

Company: Toyota Camry // Policyholder(s): State Farm Fire and Casualty Company

Company: Matt and Sarah Justice // Policyholder(s) Toyota Camry

Company: State Farm Fire and Casualty Company // Policyholder(s): Matt and Sarah Justice

Company: State Farm Fire and Casualty Company // Policyholder(s): Toyota Camry

Question 2 (2 points)

Saved

What time period is covered by this insurance policy?

Question 2 options:

From July 21, 2017 until roughly 6 months later

From July 21, 2017 until they sell the car

From July 21, 2017 until roughly one year later

All of 2007

Question 3 (2 points)

Saved

Assuming nothing changes and the bill matches this declaration page, how much will the policyholder pay for their auto insurance?

Question 3 options:

$990.46 for one year of coverage

$544.58 for one year of coverage

$544.58 for one month of coverage

$990.46 for six months of coverage

Question 4 (2 points)

Saved

Which component of the policyholder’s coverage is most expensive?

Question 4 options:

Their collision coverage

Their uninsured motor vehicle coverage

Their liability coverage

Their medical payments coverage

Question 5 (2 points)

Saved

If this policyholder causes a huge, serious accident with both bodily injuries and property damage, what is the highest amount their liability coverage will provide?

Question 5 options:

$544.58

$400,000

$300,000

Unlimited amounts, depending on the number of people injured

Question 6 (2 points)

The policyholder hit another vehicle as he swerved to avoid a hubcap lying in the middle of the road. In this two-car accident, the other driver’s car sustained $3,500 in damage. This was the policyholder’s first accident. Based on his auto policy, how much of the costs will the insurance policy cover?

Question 6 options:

$0

$1000

$3,500

$2,500

Question 7 (2 points)

The policyholder's car was damaged after a massive hail storm came through her city. The cost of repairs due to the hail damage was $350. Based on her auto policy, how much will the insurance company pay to repair the car?

Question 7 options:

$200

$150

$0

$350

Question 8 (2 points)

The policyholder is really tight on cash and wants to trim down their insurance premiums so they can devote more of their budget to paying off a large credit card debt. Which coverage makes the most sense to eliminate?

Question 8 options:

Uninsured motor vehicle coverage, because they already have car insurance, so they won’t ever be uninsured

They cannot eliminate any of this coverage -- it is all required by Federal law

Liability coverage, because it is the most expensive part of their bill

Collision coverage, because their car is quite old and the deductible is relatively high

Question 9 (2 points)

Which part of the policyholder’s insurance coverage provides payment if the policyholder is injured in an accident they cause or another insured motorist causes?

Question 9 options:

Comprehensive coverage

Medical payments coverage

Liability coverage

Uninsured motor vehicle coverage

Question 10 (2 points)

An uninsured motorist accelerates into the back of this Toyota Camry when it is stopped at a red light. The accident causes $1,000 of damage to the policyholder’s car. How much will the policyholder’s insurance pay?

Question 10 options:

$99.19

$1000

$0

$750

Answers: 2

Another question on Business

Business, 21.06.2019 17:10

Diggity dank corporation uses an activity-based costing system with two activity cost pools. diggity dank uses direct labor hours as the measure of activity in the first activity cost pool and the number of orders in the second activity cost pool. the following information relates to these two activity cost pools for last year: what was diggity dank's under- or overapplied overhead for last year? a. $17,000 overapplied b. $20,000 underapplied c. $27,000 underapplied d. $73,000 overapplied

Answers: 1

Business, 22.06.2019 13:40

A.j. was a newly hired attorney for idle time gaming, inc. even though he reported directly to the president of the company, a.j. noticed that the president always had time to converse with the director of sales, calling on him to get a pulse on legal/regulatory issues that, as the company attorney, a.j. could have probably handled. a.j. also noted that the hr manager’s administrative assistant was the go-to person for a number of things that would make life easier at work. a.j. was recognizing the culture at idle time gaming.

Answers: 3

Business, 22.06.2019 14:50

Pederson company reported the following: manufacturing costs $480,000 units manufactured 8,000 units sold 7,500 units sold for $90 per unit beginning inventory 2,000 units what is the average manufacturing cost per unit? (round the answer to the nearest dollar.)

Answers: 3

Business, 22.06.2019 19:00

What is an equation of the line in slope intercept formm = 4 and the y-intercept is (0,5)y = 4x-5y = -5x +4y = 4x + 5y = 5x +4

Answers: 1

You know the right answer?

Analyze the auto insurance declaration page and answer the questions.

What insurance company is pro...

Questions

Mathematics, 16.07.2019 03:30

Mathematics, 16.07.2019 03:30

Mathematics, 16.07.2019 03:30

English, 16.07.2019 03:30

Physics, 16.07.2019 03:30

Biology, 16.07.2019 03:30

English, 16.07.2019 03:30

Mathematics, 16.07.2019 03:30

Mathematics, 16.07.2019 03:30

English, 16.07.2019 03:30

Mathematics, 16.07.2019 03:30

Biology, 16.07.2019 03:30

Mathematics, 16.07.2019 03:30