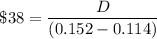

Nick's Marine Company (NMC) currently has a stock price per share of $38. If NMC's cost of equity capital (the discount rate for equity) is 15.2% and capital gains rate (gain/loss in prices relative to today's price) for the next year is expected to be 11.4%, the dividend in the upcoming year (t = 1) should be?

Answers: 3

Another question on Business

Business, 21.06.2019 17:50

When selecting stock, some financial experts recommend to look at the opening price go with what you know examine the day’s range, earnings per share, and p/e ratio divide the dividend by the asking price

Answers: 2

Business, 21.06.2019 18:20

Which of the following is intended to demonstrate to an employer the importance of cooperating with workers? a. a collective agreement. b. a stock offer. c. a boost in production. d. a work slowdown. 2b2t

Answers: 2

Business, 21.06.2019 19:30

Which of the following correctly describes the accounting for indirect labor costs? indirect labor costs are product costs and are expensed as incurred. indirect labor costs are period costs and are expensed when the manufactured product is sold. indirect labor costs are period costs and are expensed as incurred. indirect labor costs are product costs and are expensed when the manufactured product is sold.

Answers: 3

Business, 22.06.2019 06:00

If you miss two payments on a credit card what is generally the penalty

Answers: 1

You know the right answer?

Nick's Marine Company (NMC) currently has a stock price per share of $38. If NMC's cost of equity ca...

Questions

Computers and Technology, 05.01.2021 01:00

Mathematics, 05.01.2021 01:00

Mathematics, 05.01.2021 01:00

Computers and Technology, 05.01.2021 01:00

Mathematics, 05.01.2021 01:00

Geography, 05.01.2021 01:00

French, 05.01.2021 01:00

Social Studies, 05.01.2021 01:00

Mathematics, 05.01.2021 01:00

Mathematics, 05.01.2021 01:00

Biology, 05.01.2021 01:00