Business, 03.06.2021 01:20 nosleepbrooklyn2006

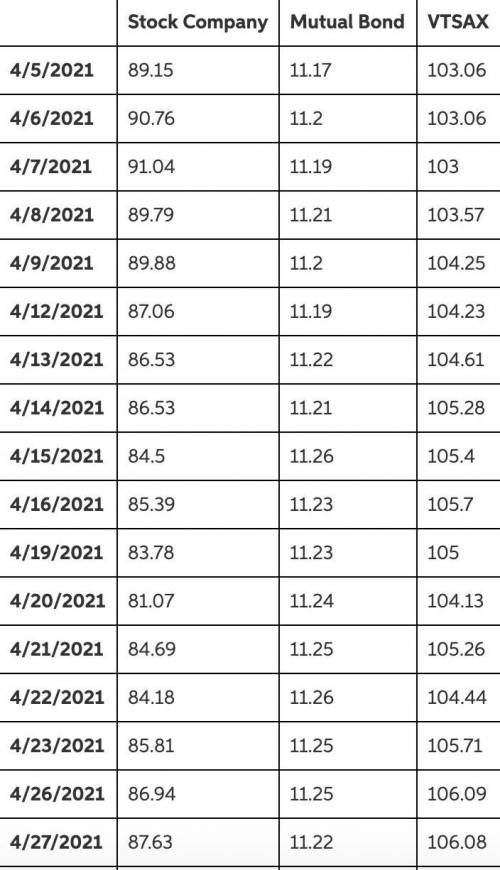

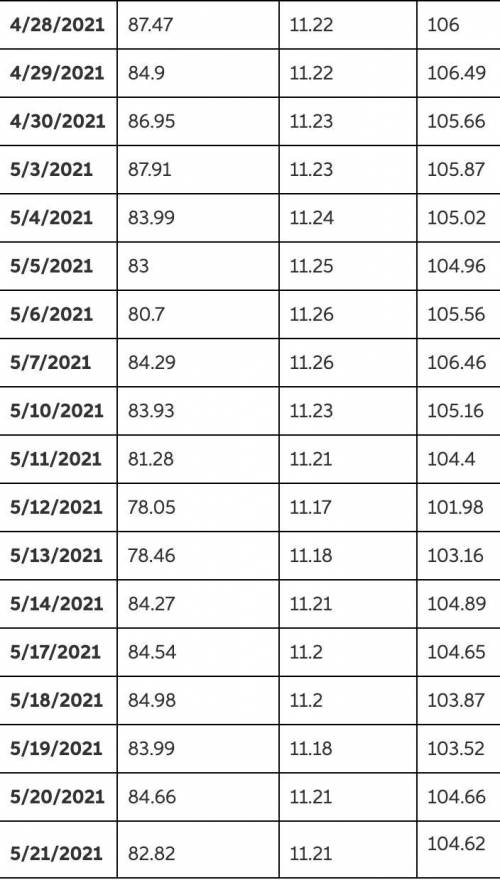

Data is in screenshots attached.

Please solve in Excel and show/explain calculations. Thank you!

The daily returns of these three assets.

The average return and standard deviation for these three assets.

The correlations between these three assets.

What is the future value for each of these assets at the end of the day on May 21st if you had $100 invested in each asset on April 5th?

What is the FV and daily returns of a portfolio that placed 70% in VTSAX and 30% in your bond mutual fund. What is the average return and standard deviation of this portfolio?

What is the FV and daily returns of a portfolio that placed 70% in your stock and 30% in your bond mutual fund. What is the average return and standard deviation of this portfolio?

What is the beta of your stock and the bond fund? Use the VTSAX as your proxy for the market.

What is the expected return on the stock for the company you are following? Use reasonable estimates of the variables that enter the CAPM.

What is the WACC for the company you chose to follow?

Answers: 3

Another question on Business

Business, 22.06.2019 08:10

The last time he flew jet value air, juan's plane developed a fuel leak and had to make an 4) emergency landing. the time before that, his plane was grounded because of an electrical problem. juan is sure his current trip will be fraught with problems and he will once again be delayed. this is an example of the bias a) confirmation b) availability c) selective perception d) randomness

Answers: 1

Business, 22.06.2019 10:50

You are evaluating two different silicon wafer milling machines. the techron i costs $285,000, has a three-year life, and has pretax operating costs of $78,000 per year. the techron ii costs $495,000, has a five-year life, and has pretax operating costs of $45,000 per year. for both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $55,000. if your tax rate is 24 percent and your discount rate is 11 percent, compute the eac for both machines.

Answers: 3

Business, 22.06.2019 22:00

The company is experiencing an increase in competition, and at the same time they are building more production facilities in southeast asia. in this scenario, the top management team is most likely to multiple choice increase the cost of their products. restructure to reflect a more bureaucratic, stable organization. pull decision-making responsibility from low-level management, taking it on themselves. give lower-level managers the authority to make decisions to benefit the firm. rid themselves of all buffering product.

Answers: 3

Business, 23.06.2019 03:50

John is a journalist he went to a product demonstration for a new computer some of what he heard was informative while the rest was meant to persuade consumers to buy the product which two statements in the excerpt are persuasive rather than informative

Answers: 2

You know the right answer?

Data is in screenshots attached.

Please solve in Excel and show/explain calculations. Thank you!

Questions

Computers and Technology, 17.10.2021 14:00

Mathematics, 17.10.2021 14:00

Physics, 17.10.2021 14:00

Mathematics, 17.10.2021 14:00

English, 17.10.2021 14:00

Mathematics, 17.10.2021 14:00

History, 17.10.2021 14:00

Arts, 17.10.2021 14:00

Geography, 17.10.2021 14:00