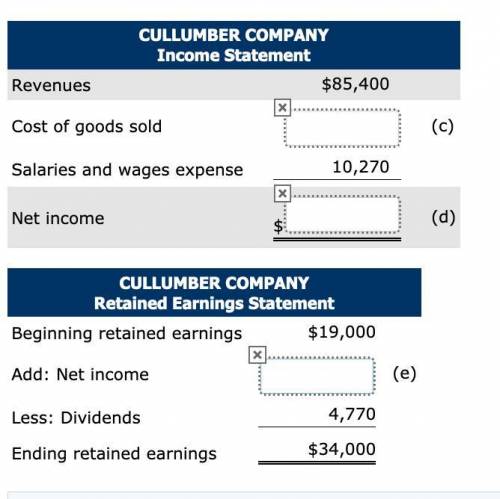

Here are incomplete financial statements for Cullumber Company. Calculate the missing amounts.

CULLUMBER COMPANY

Balance Sheet

Assets

Cash $ 14,000 Inventory 17,000 Buildings 38,000 Total assets $69,000 Liabilities and Stockholders' Equity Liabilities Accounts payable $ 5,600 Stockholders' Equity Common stock enter a dollar amount

(a) Retained earnings enter a dollar amount

(b) Total liabilities and stockholders' equity $69,000 CULLUMBER COMPANY Income Statement Revenues $85,400 Cost of goods sold enter a dollar amount

(c) Salaries and wages expense 10,270 Net income $enter a dollar amount

(d) CULLUMBER COMPANY Retained Earnings Statement Beginning retained earnings $19,000 Add: Net income enter a dollar amount

(e) Less: Dividends 4,770 Ending retained earnings $34,000

Answers: 3

Another question on Business

Business, 22.06.2019 01:30

Side bar toggle icon performance in last 10 qs hard easy performance in last 10 questions - there are '3' correct answers, '3' wrong answers, '0' skipped answers, '1' partially correct answers about this question question difficulty difficulty 60% 42.2% students got it correct study this topic • demonstrate an understanding of sampling distributions question number q 3.8: choose the correct estimate for the standard error using the 95% rule.

Answers: 2

Business, 22.06.2019 03:30

Diversified semiconductors sells perishable electronic components. some must be shipped and stored in reusable protective containers. customers pay a deposit for each container received. the deposit is equal to the container’s cost. they receive a refund when the container is returned. during 2018, deposits collected on containers shipped were $856,000. deposits are forfeited if containers are not returned within 18 months. containers held by customers at january 1, 2018, represented deposits of $587,000. in 2018, $811,000 was refunded and deposits forfeited were $41,000. required: 1. prepare the appropriate journal entries for the deposits received and returned during 2018. 2. determine the liability for refundable deposits to be reported on the december 31, 2018, balance sheet.

Answers: 1

Business, 22.06.2019 10:30

On july 1, oura corp. made a sale of $ 450,000 to stratus, inc. on account. terms of the sale were 2/10, n/30. stratus makes payment on july 9. oura uses the net method when accounting for sales discounts. ignore cost of goods sold and the reduction of inventory. a. prepare all oura's journal entries. b. what net sales does oura report?

Answers: 2

Business, 22.06.2019 11:40

Define the marginal rate of substitution between two goods (x and y). if a consumer’s preferences are given by u(x,y) = x3/4y1/4, compute the consumer’s marginal rate of substitution as a function of x and y. calculate the mrs if the consumer has chosen to consumer 48 units of x and 16 units of y. show your work. (use the back of the page if necessary.

Answers: 3

You know the right answer?

Here are incomplete financial statements for Cullumber Company. Calculate the missing amounts.

CULL...

Questions

Mathematics, 04.08.2019 14:00

Social Studies, 04.08.2019 14:00

History, 04.08.2019 14:00

World Languages, 04.08.2019 14:00

Mathematics, 04.08.2019 14:00

History, 04.08.2019 14:00

History, 04.08.2019 14:00

History, 04.08.2019 14:00

English, 04.08.2019 14:00

Mathematics, 04.08.2019 14:00