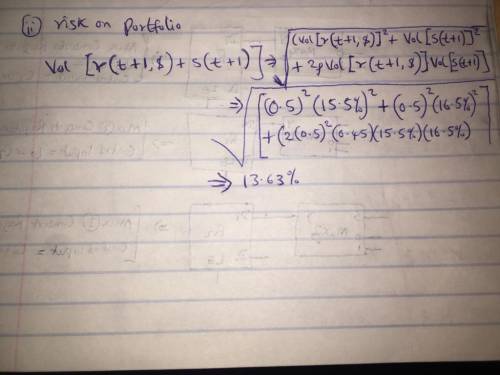

The EAFE is the international index comprising markets in Europe, Australia, and the Far East. Consider the following annualized stock return data: Average U. S. index return: 14% Average EAFE index return: 13% Volatility of the U. S. return: 15.5% Volatility of the EAFE return: 16.5% Correlation of U. S return and EAFE return: 0.45 (i) What would be the return and risk of a portfolio invested half in the EAFE and half in the U. S. market? Show your solution procedure in detail. (ii) Compare volatility of portfolio and the volatility of the U. S. return as well as the volatility of the EAFE return.

Answers: 1

Another question on Business

Business, 23.06.2019 09:30

Which part in a cover letter do you write down skills and experience

Answers: 1

Business, 23.06.2019 21:50

Michigan co. is currently paying a dividend of $2.00 per share. the dividends are expected to grow at 20% per year for the next four years and then grow 6% per year thereafter. calculate the expected dividend in year 5.

Answers: 1

Business, 24.06.2019 00:30

What type of business is strong steel manufactures? a. corporation b. partnership c. proprietorship

Answers: 1

Business, 24.06.2019 01:00

Consider two ways to protect your car from theft. the club (a steering wheel lock) makes it difficult for a car thief to take your car. lojack (a tracking system) makes it easier for the police to catch the car thief who has stolen it. if a car thief encounters a car with the club and a car without it, the car with the club imposes a externality on the car without the club. a policy implication from this result includes a those who use the club.

Answers: 2

You know the right answer?

The EAFE is the international index comprising markets in Europe, Australia, and the Far East. Consi...

Questions

History, 10.10.2020 14:01

Advanced Placement (AP), 10.10.2020 14:01

Mathematics, 10.10.2020 14:01

Mathematics, 10.10.2020 14:01

English, 10.10.2020 14:01

Social Studies, 10.10.2020 14:01

English, 10.10.2020 14:01

Mathematics, 10.10.2020 14:01

Mathematics, 10.10.2020 14:01

Mathematics, 10.10.2020 14:01