Business, 13.06.2021 04:20 plantkiana677oxa6hk

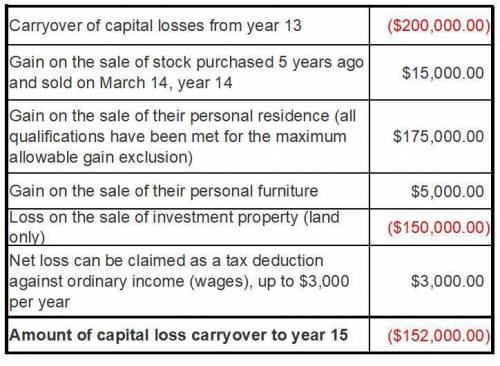

Brad and Angie are married and file a joint return. For year 14, they had income from wages in the amount of $100,000 and had the following capital transactions to report on their income tax return: Carryover of capital losses from year 13$200,000 Loss on sale of stock purchased in March year 14, sold on October 10, year 14, and repurchased on November 2, year 1420,000 Gain on the sale of stock purchased 5 years ago and sold on March 14, year 1415,000 Gain on the sale of their personal residence (all qualifications have been met for the maximum allowable gain exclusion)675,000 Loss on the sale of their personal automobile10,000 Gain on the sale of their personal furniture5,000 Loss on the sale of investment property (land only)150,000 What is the amount of capital loss carryover to year 15

Answers: 3

Another question on Business

Business, 22.06.2019 09:20

Which statement best defines tuition? tuition is federal money awarded to a student. tuition is aid given to a student by an institution. tuition is money borrowed to pay for an education. tuition is the price of attending classes at a school.

Answers: 1

Business, 22.06.2019 11:00

Aprofessional does specialized work that's primarily: degree based. medical or legal. well paying. intellectual and creative

Answers: 2

Business, 22.06.2019 17:40

To appeal to a new target market, the maker of hill's coffee has changed the product's package design, reformulated the coffee, begun advertising price discounts in women's magazines, and started distributing the product through gourmet coffee shops. what has been changed? a. the product's perceptual value. b.the product's 4ps. c. the method used in its target marketing. d. the ownership of the product line. e. the product's utility.

Answers: 3

Business, 22.06.2019 19:30

Do a swot analysis for the business idea you chose in question 2 above. describe at least 2 strengths, 2 weaknesses, 2 opportunities, and 2 threats for that company idea.

Answers: 2

You know the right answer?

Brad and Angie are married and file a joint return. For year 14, they had income from wages in the a...

Questions

Biology, 11.11.2019 19:31

History, 11.11.2019 19:31

Chemistry, 11.11.2019 19:31

Physics, 11.11.2019 19:31

History, 11.11.2019 19:31

Mathematics, 11.11.2019 19:31

Health, 11.11.2019 19:31