Business, 24.06.2021 17:30 dabizgaming7575

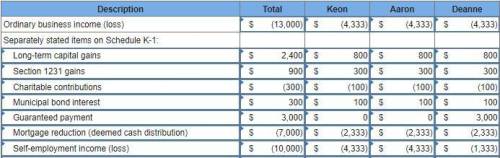

Aaron, Deanne, and Keon formed the Blue Bell General Partnership at the beginning of the current year. Aaron and Deanne each contributed $110,000 and Keon transferred an acre of undeveloped land to the partnership. The land had a tax basis of $70,000 and was appraised at $180,000. The land was also encumbered with a $70,000 nonrecourse mortgage for which no one was personally liable. All three partners agreed to split profits and losses equally. At the end of the first year Blue Bell made a $7,000 principal payment on the mortgage. For the first year of operations, the partnership records disclosed the following information:

Sales revenue $470,000

Cost of goods sold $410,000

Operating expenses $70,000

Long-term capital gains $2,400

§1231 gains $900

Charitable contributions $300

Municipal bond interest $300

Salary paid as a guaranteed payment to Deanne (not included in expenses) $3,000

a. Compute the adjusted basis of each partner’s interest in the partnership immediately after the formation of the partnership.

b. List the separate items of partnership income, gains, losses, and deductions that the partners must show on their individual income tax returns that include the results of the partnership’s first year of operations.

c. (Optional) Using the information generated in answering parts a. and b., prepare Blue Bells’ page 1 and Schedule K to be included with its Form 1065 for its first year of operations along with Schedule K-1 for Deanne.

d. What are the partners’ adjusted bases in their partnership interests at the end of the first year of operations?

Answers: 2

Another question on Business

Business, 21.06.2019 20:30

Juniper company uses a perpetual inventory system and the gross method of accounting for purchases. the company purchased $9,750 of merchandise on august 7 with terms 1/10, n/30. on august 11, it returned $1,500 worth of merchandise. on august 26, it paid the full amount due. the correct journal entry to record the merchandise return on august 11 is:

Answers: 3

Business, 22.06.2019 17:40

Take it all away has a cost of equity of 11.11 percent, a pretax cost of debt of 5.36 percent, and a tax rate of 40 percent. the company's capital structure consists of 67 percent debt on a book value basis, but debt is 33 percent of the company's value on a market value basis. what is the company's wacc

Answers: 2

Business, 22.06.2019 20:30

John and daphne are saving for their daughter ellen's college education. ellen just turned 10 at (t = 0), and she will be entering college 8 years from now (at t = 8). college tuition and expenses at state u. are currently $14,500 a year, but they are expected to increase at a rate of 3.5% a year. ellen should graduate in 4 years--if she takes longer or wants to go to graduate school, she will be on her own. tuition and other costs will be due at the beginning of each school year (at t = 8, 9, 10, and 11).so far, john and daphne have accumulated $15,000 in their college savings account (at t = 0). their long-run financial plan is to add an additional $5,000 in each of the next 4 years (at t = 1, 2, 3, and 4). then they plan to make 3 equal annual contributions in each of the following years, t = 5, 6, and 7. they expect their investment account to earn 9%. how large must the annual payments at t = 5, 6, and 7 be to cover ellen's anticipated college costs? a. $1,965.21b. $2,068.64c. $2,177.51d. $2,292.12e. $2,412.76

Answers: 1

Business, 23.06.2019 01:30

What is a market? a. a system that allows people or companies to buy and sell products and services b. the number of companies willing to manufacture a specific product c. the ability to buy production materials in large quantities and save on costs d. a product's ability to satisfy a consumer

Answers: 2

You know the right answer?

Aaron, Deanne, and Keon formed the Blue Bell General Partnership at the beginning of the current yea...

Questions

Biology, 20.01.2021 22:30

Social Studies, 20.01.2021 22:30

Biology, 20.01.2021 22:30

Mathematics, 20.01.2021 22:30

Arts, 20.01.2021 22:30

Mathematics, 20.01.2021 22:30

Geography, 20.01.2021 22:30

English, 20.01.2021 22:30

English, 20.01.2021 22:30

History, 20.01.2021 22:30

History, 20.01.2021 22:30