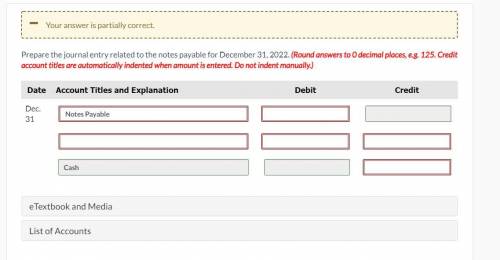

Anthony purchased a new piece of equipment to be used in its new facility. The $400,000 piece of equipment was purchased with a $40,000 down payment and with cash received through the issuance of a $360,000, 9%, 5-year mortgage payable issued on January 1, 2022. The terms provide for annual installment payments of $92,553 on December 31.

1.) Prepare an installment payments schedule for the first five payments of the notes payable. (Round answers to 0 decimal places, e. g. 125.)

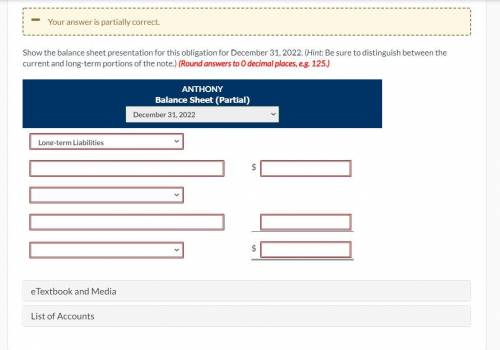

2.) Prepare the journal entry related to the notes payable for December 31, 2022. (Round answers to 0 decimal places, e. g. 125. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

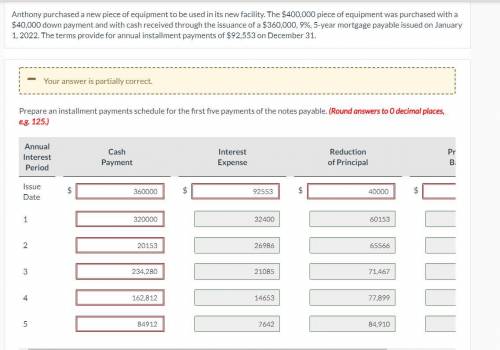

3.) Show the balance sheet presentation for this obligation for December 31, 2022. (Hint: Be sure to distinguish between the current and long-term portions of the note.) (Round answers to 0 decimal places, e. g. 125.)

Answers: 2

Another question on Business

Business, 22.06.2019 08:30

Kiona co. set up a petty cash fund for payments of small amounts. the following transactions involving the petty cash fund occurred in may (the last month of the company's fiscal year). may 1 prepared a company check for $350 to establish the petty cash fund. 15 prepared a company check to replenish the fund for the following expenditures made since may 1. a. paid $109.20 for janitorial services. b. paid $89.15 for miscellaneous expenses. c. paid postage expenses of $60.90. d. paid $80.01 to the county gazette (the local newspaper) for an advertisement. e. counted $26.84 remaining in the petty cashbox. 16 prepared a company check for $200 to increase the fund to $550. 31 the petty cashier reports that $380.27 cash remains in the fund. a company check is drawn to replenish the fund for the following expenditures made since may 15. f. paid postage expenses of $59.10. g. reimbursed the office manager for business mileage, $47.05. h. paid $48.58 to deliver merchandise to a customer, terms fob destination. 31 the company decides that the may 16 increase in the fund was too large. it reduces the fund by $50, leaving a total of $500.

Answers: 1

Business, 22.06.2019 11:10

The green fiddle has declared a $5 per share dividend. suppose capital gains are not taxed, but dividends are taxed at 15 percent. new irs regulations require that taxes be withheld at the time the dividend is paid. green fiddle stock sells for $71.50 per share, and the stock is about to go ex-dividend. what will the ex-dividend price be?

Answers: 2

Business, 23.06.2019 06:50

How is a federal loan different from a private loan for an education? a federal loan is available for any student who meets the government's lending standards. a private loan is only available for students who show a need. a federal loan is only available for students who show a need. a private loan is available for any student who meets the bank's lending standards. a federal loan can only be used to pay for a student's tuition. a private loan can be used to pay for a student's tuition and any other expenses. a federal loan can be used to pay for a student's tuition and any other expenses. a private loan can only be used to pay for a student's tuition.

Answers: 1

You know the right answer?

Anthony purchased a new piece of equipment to be used in its new facility. The $400,000 piece of equ...

Questions

Biology, 17.11.2020 16:50

English, 17.11.2020 16:50

Mathematics, 17.11.2020 16:50

Mathematics, 17.11.2020 16:50

Mathematics, 17.11.2020 16:50

Biology, 17.11.2020 16:50