Business, 01.07.2021 15:20 torresq6647

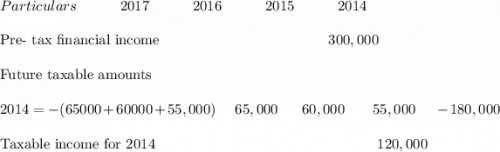

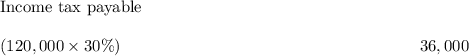

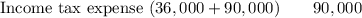

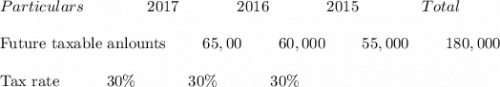

South Carolina Corporation has one temporary difference at the end of 2014 that will reverse and cause taxable amounts of $55,000 in 2015, $60,000 in 2016, and $65,000 in 2017. South Carolina's pretax financial income for 2014 is $300,000, and the tax rate is 30% for all years. There are no deferred taxes at the beginning of 2014.Instructions(a) Compute taxable income and income taxes payable for 2014.(b) Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2014.(c) Prepare the income tax expense section of the income statement for 2014, beginning with the line ?Income before income taxes.?

Answers: 2

Another question on Business

Business, 22.06.2019 16:20

The following information relates to the pina company. date ending inventory price (end-of-year prices) index december 31, 2013 $73,700 100 december 31, 2014 100,092 114 december 31, 2015 107,856 126 december 31, 2016 123,009 131 december 31, 2017 113,288 136 use the dollar-value lifo method to compute the ending inventory for pina company for 2013 through 2017.

Answers: 1

Business, 23.06.2019 01:00

Bob, an employee at machina corp., is well known among his colleagues because of his temper and impatience. during a heated argument with one of his supervisors, he reacts with hostility. bob's manager calls him in for a discussion and listens to what he has to say about the incident, while treating him with dignity and respect. this scenario can be best categorized as one that used

Answers: 3

Business, 23.06.2019 01:40

During a liquidation, a partner's capital account balance drops below zero. what should happen? select one: a. the deficit balance should be removed from the accounting records with only the remaining partners sharing in future gains and losses.b. the partner with a deficit should contribute enough assets to offset the deficit balance if he is solvent.c. the other partners should contribute enough assets to offset the amount of deficit if the partner with a deficit is insolvent.d. both b & c

Answers: 3

You know the right answer?

South Carolina Corporation has one temporary difference at the end of 2014 that will reverse and cau...

Questions

English, 29.09.2019 10:30

Biology, 29.09.2019 10:30

Mathematics, 29.09.2019 10:30

Social Studies, 29.09.2019 10:30

History, 29.09.2019 10:30

History, 29.09.2019 10:30