The total market value of the equity of ITM is $6 million, and the total value of its debt is $4

million. The treasurer estimates that the beta of the stock currently is 1.2 and that the expected

risk premium on the market is 10%. The Treasury bill rate is 4%, and investors believe that

ITM’s debt is essentially free of default risk.

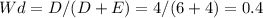

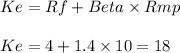

a. What is the required rate of return on ITM stock?

b. Estimate the WACC assuming a tax rate of 40%.

c. Estimate the discount rate for an expansion of the company’s present business.

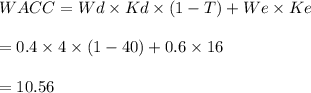

d. Suppose the company wants to diversify into the manufacture of rose-colored glasses. The beta

of optical manufacturers with no debt outstanding is 1.4. What is the required rate of return on

ITM’s new venture? (Assume that the risky project will not enable the firm to issue any

additional debt.)

Answers: 1

Another question on Business

Business, 21.06.2019 21:00

In addition to having a bachelor's degree in accounting, a certification will increase a tax accountant's job opportunities and allow them to file reports with the

Answers: 1

Business, 21.06.2019 21:30

Peninsula products has just applied for a loan at your bank. when reviewing peninsula's books for the year that just ended, you notice that the firm uses the fair value option for its bonds payable. you also see that the firm recorded a $55,000 debit in its bonds payable account and a $55,000 credit in its unrealized holding gain or loss"income account. over that same period, interest rates decreased by about 0.5 percent. how should this information affect the bank's decision as to whether to grant peninsula a loan? a : the bank should strongly consider giving a loan to peninsula because the changes in firm's bonds payable and unrealized holding gain or loss"income accounts suggest that peninsula has seen an increase in its credit rating over the past year. b : the bank should put little emphasis on the changes in peninsula's bonds payable and unrealized holding gain or loss"income accounts because these changes are likely the result of the rise in interest rates. c : the bank should hesitate before giving a loan to peninsula because the changes in firm's bonds payable and unrealized holding gain or loss"income accounts suggest that peninsula has seen a decline in its credit rating over the past year. d : the bank should put little emphasis on the changes in peninsula's bonds payable and unrealized holding gain or loss"income accounts because these changes are likely unrelated to either interest rates or the firm's credit rating.

Answers: 2

Business, 21.06.2019 22:30

True or false: banks are required to make electronically deposited funds available on the same day of the deposit

Answers: 2

Business, 22.06.2019 06:00

Josie just bought her first fish tank a 36 -gallon glass aquarium, which she’s been saving up for almost a year to buy. for josie, the fish tank is most likely what type of purchase

Answers: 1

You know the right answer?

The total market value of the equity of ITM is $6 million, and the total value of its debt is $4

mi...

Questions

Chemistry, 15.01.2021 01:00

Mathematics, 15.01.2021 01:00

Mathematics, 15.01.2021 01:00

English, 15.01.2021 01:00

Mathematics, 15.01.2021 01:00

Mathematics, 15.01.2021 01:00

Mathematics, 15.01.2021 01:00

Mathematics, 15.01.2021 01:00

Mathematics, 15.01.2021 01:00

Biology, 15.01.2021 01:00

%.

%.