Business, 09.07.2021 17:20 eymurezgi1

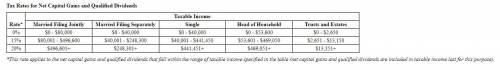

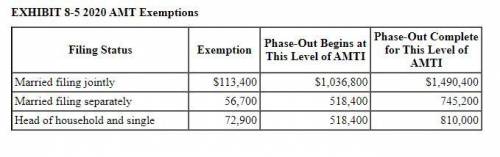

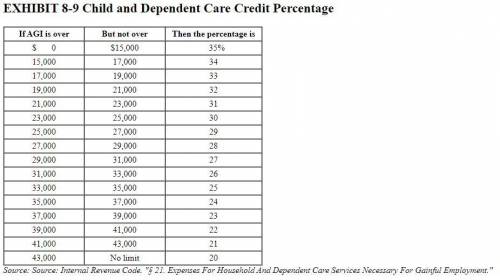

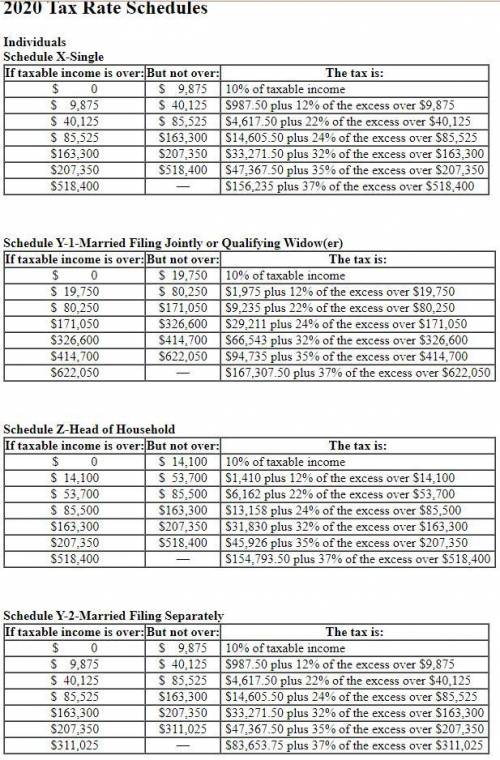

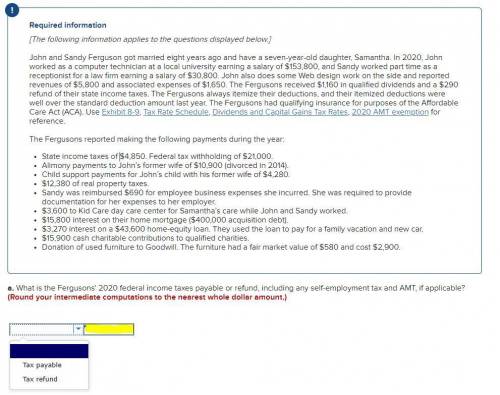

John and Sandy Ferguson got married eight years ago and have a seven-year-old daughter, Samantha. In 2020, John worked as a computer technician at a local university earning a salary of $153,800, and Sandy worked part time as a receptionist for a law firm earning a salary of $30,800. John also does some Web design work on the side and reported revenues of $5,800 and associated expenses of $1,650. The Fergusons received $1,160 in qualified dividends and a $290 refund of their state income taxes. The Fergusons always itemize their deductions, and their itemized deductions were well over the standard deduction amount last year. The Fergusons had qualifying insurance for purposes of the Affordable Care Act (ACA). Use Exhibit 8-9, Tax Rate Schedule, Dividends and Capital Gains Tax Rates, 2020 AMT exemption for reference The Fergusons reported making the following payments during the year: • State income taxes of $4,850. Federal tax withholding of $21,000. Alimony payments to John's former wife of $10,900 (divorced in 2014). • Child support payments for John's child with his former wife of $4,280. • $12,380 of real property taxes. Sandy was reimbursed $690 for employee business expenses she incurred. She was required to provide documentation for her expenses to her employer. $3,600 to Kid Care day care center for Samantha's care while John and Sandy worked. • $15,800 interest on their home mortgage ($400,000 acquisition debt). $3,270 interest on a $43,600 home-equity loan. They used the loan to pay for a family vacation and new car. $15,900 cash charitable contributions to qualified charities. Donation of used furniture to Goodwill. The furniture had a fair market value of $580 and cost $2,900. a. What is the Fergusons' 2020 federal income taxes payable or refund, including any self-employment tax and AMT, if applicable? (Round your intermediate computations to the nearest whole dollar amount.)

Owing $17,134 is NOT the answer.

They get a refund - that's correct.

But a refund of $295.75 is also NOT correct.

Answers: 3

Another question on Business

Business, 22.06.2019 12:30

Amap from a trade development commission or chamber of commerce can be more useful than google maps for identifying

Answers: 1

Business, 22.06.2019 16:10

The brs corporation makes collections on sales according to the following schedule: 30% in month of sale 66% in month following sale 4% in second month following sale the following sales have been budgeted: sales april $ 130,000 may $ 150,000 june $ 140,000 budgeted cash collections in june would be:

Answers: 1

Business, 22.06.2019 16:30

Corrective action must be taken for a project when (a) actual progress to the planned progress shows the progress is ahead of schedule. (b) the technical specifications have been met. (c) the actual cost of the activities is less than the funds received for the work completed. (d) the actual progress is less than the planned progress.

Answers: 2

Business, 22.06.2019 21:00

The purpose of the transportation approach for location analysis is to minimize which of the following? a. total costsb. total fixed costsc. the number of shipmentsd. total shipping costse. total variable costs

Answers: 1

You know the right answer?

John and Sandy Ferguson got married eight years ago and have a seven-year-old daughter, Samantha. In...

Questions

Chemistry, 12.10.2019 14:00

Mathematics, 12.10.2019 14:00

History, 12.10.2019 14:00

Physics, 12.10.2019 14:00

Mathematics, 12.10.2019 14:00

Mathematics, 12.10.2019 14:00

English, 12.10.2019 14:00

Social Studies, 12.10.2019 14:00

English, 12.10.2019 14:00

Mathematics, 12.10.2019 14:00

Computers and Technology, 12.10.2019 14:00

Arts, 12.10.2019 14:00