Business, 23.07.2021 01:30 cdradlet2001

The manager of a small post office is concerned that the growing township is overloading the one-window service being offered. Sample data are collected on 100 individuals who arrive for service:

Time between Arrivals

(inter arrival time)

(minutes) Frequency

1 8

2 35

3 34

4 17

5 6

Service Time

(minutes) Frequency

1.0 12

1.5 21

2.0 36

2.5 19

3.0 7

3.5 5

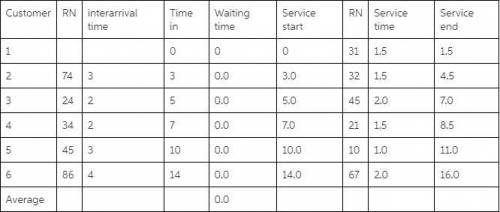

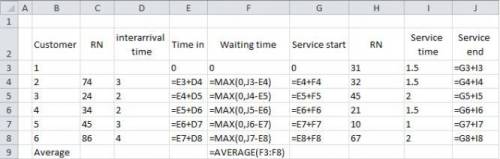

Using the following random number sequence, simulate six arrivals, assume the first arrival is time 0.

RN for inter-arrivals: 08, 74, 24, 34, 45, 86

RN for service time: 31, 32, 45, 21, 10, 67

1. What is the time required to serve the third customer?

2. When does the operator begin processing the fourth customer?

3. How long is the fifth customer wait in line?

4. When the sixth customer arrives, will the customer get served right away?

5. For the six customers simulated above, what is the average waiting time?

Answers: 3

Another question on Business

Business, 22.06.2019 08:10

The last time he flew jet value air, juan's plane developed a fuel leak and had to make an 4) emergency landing. the time before that, his plane was grounded because of an electrical problem. juan is sure his current trip will be fraught with problems and he will once again be delayed. this is an example of the bias a) confirmation b) availability c) selective perception d) randomness

Answers: 1

Business, 22.06.2019 08:30

Uppose that the federal reserve purchases a bond for $100,000 from donald truck, who deposits the proceeds in the manufacturer’s national bank. what will be the impact of this purchase on the supply of money? the money supply will increase by $100,000. the money supply will increase by $80,000. the money supply will increase by $500,000. this action will have no effect on the money supply. if the reserve requirement ratio is 20 percent, what is the maximum amount of additional loans that the manufacturer’s bank will be able to extend as the result of truck’s deposit? the maximum additional loans is $100,000. the maximum additional loans is $80,000. the maximum additional loans is $20,000. the maximum additional loans is $500,000. given the 20 percent reserve requirement, what is the maximum increase in the quantity of checkable deposits that could result throughout the entire banking system because of the fed’s action? this action will have no effect on the money supply. the money supply will eventually increase by $80,000. the money supply will eventually increase by $500,000. the money supply will eventually increase by $100,000.

Answers: 1

Business, 22.06.2019 10:40

Two assets have the following expected returns and standard deviations when the risk-free rate is 5%: asset a e(ra) = 18.5% σa = 20% asset b e(rb) = 15% σb = 27% an investor with a risk aversion of a = 3 would find that on a risk-return basis. a. only asset a is acceptable b. only asset b is acceptable c. neither asset a nor asset b is acceptable d. both asset a and asset b are acceptable

Answers: 2

Business, 22.06.2019 12:00

Identify at least 3 body language messages that project a positive attitude

Answers: 2

You know the right answer?

The manager of a small post office is concerned that the growing township is overloading the one-win...

Questions

Mathematics, 08.10.2020 17:01

Computers and Technology, 08.10.2020 17:01

History, 08.10.2020 18:01

Mathematics, 08.10.2020 18:01

Mathematics, 08.10.2020 18:01

Computers and Technology, 08.10.2020 18:01