Answers: 3

Another question on Business

Business, 21.06.2019 22:10

There are more than two types of bachelors’ degrees true or false?

Answers: 1

Business, 22.06.2019 06:30

Select all that apply. select the ways that labor unions can increase wages. collective bargaining reducing the labor supply increasing the demand for labor creating monopolies

Answers: 1

Business, 22.06.2019 12:10

Bonds often pay a coupon twice a year. for the valuation of bonds that make semiannual payments, the number of periods doubles, whereas the amount of cash flow decreases by half. using the values of cash flows and number of periods, the valuation model is adjusted accordingly. assume that a $1,000,000 par value, semiannual coupon us treasury note with three years to maturity has a coupon rate of 3%. the yield to maturity (ytm) of the bond is 7.70%. using this information and ignoring the other costs involved, calculate the value of the treasury note:

Answers: 1

You know the right answer?

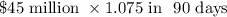

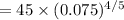

Your firm has $45.0 million invested in accounts receivable, which is 90 days of net revenues. If th...

Questions

Mathematics, 25.04.2021 06:50

Mathematics, 25.04.2021 06:50

Mathematics, 25.04.2021 06:50

Mathematics, 25.04.2021 06:50

Advanced Placement (AP), 25.04.2021 06:50

History, 25.04.2021 06:50

Spanish, 25.04.2021 06:50

Mathematics, 25.04.2021 06:50

Mathematics, 25.04.2021 06:50

Mathematics, 25.04.2021 07:00

English, 25.04.2021 07:00

Advanced Placement (AP), 25.04.2021 07:00

English, 25.04.2021 07:00

days.

days.

days =

days =  return, and

return, and

million increase

million increase