AP12-2 Financial Analysis: American Eagle Outfitters, Inc.

Financial information for American Eagle is presented in Appendix A.

Required:

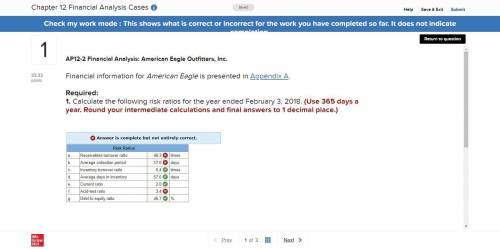

1. Calculate the following risk ratios for the year ended February 3, 2018. (Use 365 days a year. Round your intermediate calculations and final answers to 1 decimal place.)

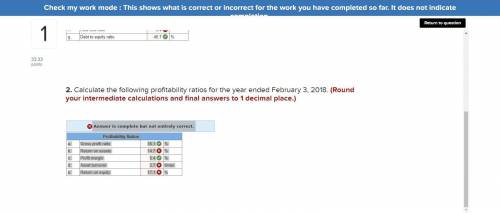

2. Calculate the following profitability ratios for the year ended February 3, 2018. (Round your intermediate calculations and final answers to 1 decimal place.)

https://eztocfmedia. mheducation. com/Media/Connect_Production/bne/ac counting/spiceland_fin5e/spiceland_ fin5e_app_a. pdf

Answers: 3

Another question on Business

Business, 21.06.2019 19:20

In 2007, americans smoked 19.2 billion packs of cigarettes. they paid an average retail price of $4.50 per pack. a. given that the elasticity of supply is 0.50.5 and the elasticity of demand is negative 0.4−0.4, derive linear demand and supply curves for cigarettes. the demand equation is qdequals=nothingplus+nothing times ×p and the supply equation is qsequals=nothingplus+nothing times ×p.

Answers: 2

Business, 21.06.2019 20:50

Tyler has coffee with one of his direct reports almost daily. he does this to inquire in an informal way about progress on the job, and to provide coaching and support, as well as appropriate congratulations for special efforts. tyler is exhibiting which type of managerial skill?

Answers: 1

Business, 22.06.2019 02:00

Jamie lee is reviewing her finances one month later. she has provided the actual amounts paid below. use the cash budget table below to her identify the variances in her budget. each answer must have a value for the assignment to be complete. enter "0" for any unused categories. actual amounts income: monthly expenses: gross monthly salary $2,315 rent obligation $260 net monthly salary $1,740 utilities/electricity $130 savings allocation: utilities/water $10 regular savings $130 utilities/cable tv $155 rainy-day savings $20 food $160 entertainment: gas/maintenance $205 cake decorating class $90 credit card payment $25 movies with friends $50 car insurance $75 clothing $145 budgeted amounts assets: monthly expenses: checking account $1,850 rent obligation $225 emergency fund savings account $4,300 utilities/electricity $75 car $5,200 utilities/water $35 computer & ipad $1,100 utilities/cable tv $120 liabilities: food $115 student loan $6,600 gas/maintenance $95 credit card balance $1,000 credit card payment $45 income: car insurance $45 gross monthly salary $2,155 clothing $45 net monthly salary $1,580 entertainment: savings allocation: cake decorating class $90 regular savings $130 movies with friends $50 rainy day savings $20

Answers: 2

Business, 22.06.2019 07:10

mark, a civil engineer, entered into a contract with david. as per the contract, mark agreed to design and build a house for david for a specified fee. mark provided david with an estimation of the total cost and the contract was mutually agreed upon. however, during construction, when mark increased the price due to a miscalculation on his part, david refused to pay the amount. this scenario is an example of a mistake.

Answers: 1

You know the right answer?

AP12-2 Financial Analysis: American Eagle Outfitters, Inc.

Financial information for American Eagl...

Questions

Mathematics, 13.01.2021 23:30

Mathematics, 13.01.2021 23:30

Mathematics, 13.01.2021 23:30

Mathematics, 13.01.2021 23:30

Mathematics, 13.01.2021 23:30

Mathematics, 13.01.2021 23:30

English, 13.01.2021 23:30

Mathematics, 13.01.2021 23:30

Mathematics, 13.01.2021 23:30

Biology, 13.01.2021 23:30

History, 13.01.2021 23:30