Business, 28.08.2021 01:10 carlos113101

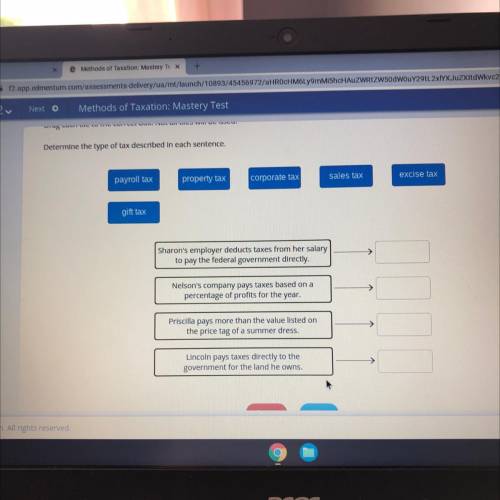

Drag each tile to the correct box. Not all tiles will be used.

Determine the type of tax described in each sentence.

payroll tax

excise tax

property tax corporate tax

sales tax

gift tax

Sharon's employer deducts taxes from her salary

to pay the federal government directly.

>

Nelson's company pays taxes based on a

percentage of profits for the year.

>

Priscilla pays more than the value listed on

the price tag of a summer dress.

Lincoln pays taxes directly to the

government for the land he owns.

Answers: 2

Another question on Business

Business, 22.06.2019 01:00

Cooper, cpa, is auditing the financial statements of a small rural municipality. the receivable balances represent residents’ delinquent real estate taxes. internal control at the municipality is weak. to determine the existence of the accounts receivable balances at the balance sheet date, cooper would most likely: cooper, cpa, is auditing the financial statements of a small rural municipality. the receivable balances represent residents’ delinquent real estate taxes. internal control at the municipality is weak. to determine the existence of the accounts receivable balances at the balance sheet date, cooper would most likely:

Answers: 3

Business, 22.06.2019 09:50

phillips, inc. had the following financial data for the year ended december 31, 2019. cash $ 41,000 cash equivalents 75,000 long term investments 59,000 total current liabilities 149,000 what is the cash ratio as of december 31, 2019, for phillips, inc.? (round your answer to two decimal places.)

Answers: 3

Business, 22.06.2019 13:40

Salge inc. bases its manufacturing overhead budget on budgeted direct labor-hours. the variable overhead rate is $8.10 per direct labor-hour. the company's budgeted fixed manufacturing overhead is $74,730 per month, which includes depreciation of $20,670. all other fixed manufacturing overhead costs represent current cash flows. the direct labor budget indicates that 5,300 direct labor-hours will be required in september. the company recomputes its predetermined overhead rate every month. the predetermined overhead rate for september should be:

Answers: 3

You know the right answer?

Drag each tile to the correct box. Not all tiles will be used.

Determine the type of tax described...

Questions

History, 06.12.2021 18:40

Biology, 06.12.2021 18:40

Mathematics, 06.12.2021 18:40

Mathematics, 06.12.2021 18:40

Mathematics, 06.12.2021 18:40

Mathematics, 06.12.2021 18:40

Chemistry, 06.12.2021 18:40

History, 06.12.2021 18:40

Mathematics, 06.12.2021 18:40