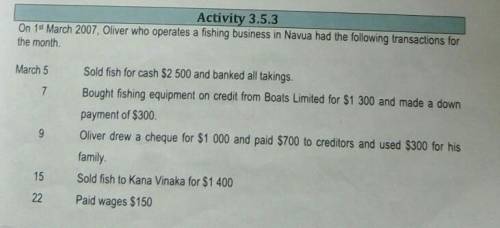

Prepare an Analysis Chart

...

Answers: 2

Another question on Business

Business, 22.06.2019 19:10

Pam is a low-risk careful driver and fran is a high-risk aggressive driver. to reveal their driver types, an auto-insurance company a. refuses to insure high-risk drivers b. charges a higher premium to owners of newer cars than to owners of older cars c. offers policies that enable drivers to reveal their private information d. uses a pooling equilibrium e. requires drivers to categorize themselves as high-risk or low-risk on the application form

Answers: 3

Business, 22.06.2019 22:30

Luggage world buys briefcases with an invoice date of september 28. the terms of sale are 2/10 eom. what is the net date for this invoice

Answers: 1

Business, 23.06.2019 13:30

Amarginally attached worker is a person who is not happy with his or her job. someone who works part-time more than 25 hours per week but wants full-time work. someone who does not have a job but is available and willing to work and has made specific but unsuccessful efforts to find a job during the past 4 weeks. someone who does not have a job but is available and willing to work but has not made specific efforts to find a job during the past 4 weeks. another name for an unemployed worker.

Answers: 2

Business, 23.06.2019 17:20

Apractitioner is engaged to prepare a client's federal income tax return for 2017 and 2018. the practitioner files the 2017 return on the client's behalf and provided copies of the 2017 return and all related documents to the client. after the 2018 return is prepared, the client disputes the fees for the 2018 tax engagement, terminates the relationship, and requests all tax returns and related records. the client has not yet paid for preparation of the 2018 return. under irs circular 230, which records must the practitioner return to the client? a.) notes the practitioner took when meeting with the client about the 2017 and 2018 tax returns. b.) the engagement letter executed by the client for preparation of the 2018 federal income tax return. c.) an appraisal the practitioner prepared in connection with the 2017 federal income tax return. d.) schedules the practitioner prepared, which the client needs to file in its 2018 federal income tax return.

Answers: 1

You know the right answer?

Questions

Business, 11.08.2021 02:00

History, 11.08.2021 02:00

Mathematics, 11.08.2021 02:00

Geography, 11.08.2021 02:00

Mathematics, 11.08.2021 02:00