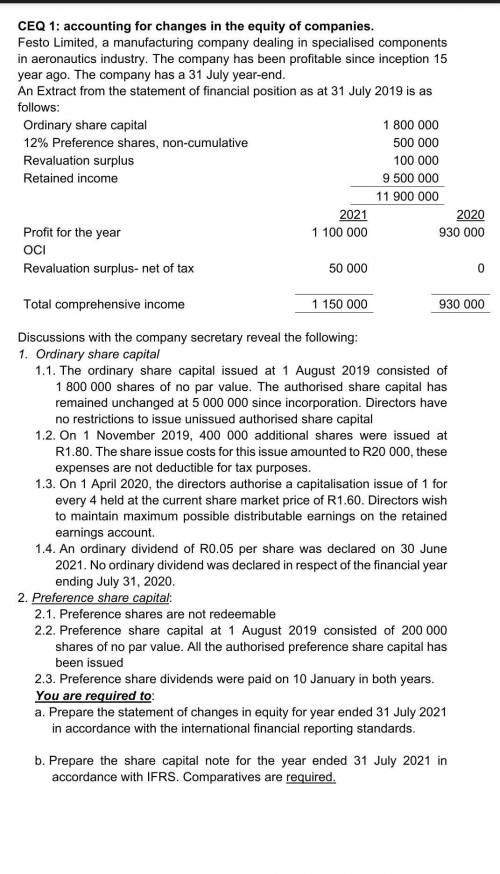

Festo Limited, a manufacturing company dealing in specialised components in aeronautics industry. The company has been profitable since inception 15 year ago. The company has a 31 July year-end. An Extract from the statement of financial position as at 31 July 2019 is as follows: Ordinary share capital 1 800 000 12% Preference shares, non-cumulative 500 000 Revaluation surplus 100 000 Retained income 9 500 000 11 900 000 2021 2020 Profit for the year 1 100 000 930 000 OCI Revaluation surplus- net of tax 50 000 0 Total comprehensive income 1 150 000 930 000 Discussions with the company secretary reveal the following: 1. Ordinary share capital 1.1. The ordinary share capital issued at 1 August 2019 consisted of 1 800 000 shares of no par value. The authorised share capital has remained unchanged at 5 000 000 since incorporation. Directors have no restrictions to issue unissued authorised share capital 1.2. On 1 November 2019, 400 000 additional shares were issued at R1.80. The share issue costs for this issue amounted to R20 000, these expenses are not deductible for tax purposes. 1.3. On 1 April 2020, the directors authorise a capitalisation issue of 1 for every 4 held at the current share market price of R1.60. Directors wish to maintain maximum possible distributable earnings on the retained earnings account. 1.4. An ordinary dividend of R0.05 per share was declared on 30 June 2021. No ordinary dividend was declared in respect of the financial year ending July 31, 2020. 2. Preference share capital: 2.1. Preference shares are not redeemable 2.2. Preference share capital at 1 August 2019 consisted of 200 000 shares of no par value. All the authorised preference share capital has been issued 2.3. Preference share dividends were paid on 10 January in both years. You are required to: a. Prepare the statement of changes in equity for year ended 31 July 2021 in accordance with the international financial reporting standards. b. Prepare the share capital note for the year ended 31 July 2021 in accordance with IFRS. Comparatives are required.

Answers: 1

Another question on Business

Business, 22.06.2019 03:40

Oceanside marine company manufactures special metallic materials and decorative fittings for luxury yachts that require highly skilled labor. oceanside uses standard costs to prepare its flexible budget. for the first quarter of the year, direct materials and direct labor standards for one of their popular products were as follows: direct materials: 2 pound per unit; $ 11 per pound direct labor: 2 hours per unit; $ 19 per hour oceanside produced 2 comma 000 units during the quarter. at the end of the quarter, an examination of the direct materials records showed that the company used 7 comma 500 pounds of direct materials and actual total materials costs were $ 98 comma 100. what is the direct materials cost variance? (round any intermediate calculations to the nearest cent, and your final answer to the nearest dollar.)

Answers: 1

Business, 22.06.2019 06:40

Burke enterprises is considering a machine costing $30 billion that will result in initial after-tax cash savings of $3.7 billion at the end of the first year, and these savings will grow at a rate of 2 percent per year for 11 years. after 11 years, the company can sell the parts for $5 billion. burke has a target debt/equity ratio of 1.2, a beta of 1.79. you estimate that the return on the market is 7.5% and t-bills are currently yielding 2.5%. burke has two issuances of bonds outstanding. the first has 200,000 bonds trading at 98% of par, with coupons of 5%, face of $1000, and maturity of 5 years. the second has 500,000 bonds trading at par, with coupons of 7.5%, face of $1000, and maturity of 12 years. kate, the ceo, usually applies an adjustment factor to the discount rate of +2 for such highly innovative projects. should the company take on the project?

Answers: 1

Business, 22.06.2019 07:40

Alicia has a collision deductible of $500 and a bodily injury liability coverage limit of $50,000. she hits another driver and injures them severely. the case goes to trial and there is a verdict to compensate the injured person for $40,000 how much does she pay?

Answers: 1

Business, 22.06.2019 08:00

Why do police officers get paid less than professional baseball players?

Answers: 2

You know the right answer?

Festo Limited, a manufacturing company dealing in specialised components in aeronautics industry. Th...

Questions

History, 22.06.2019 10:00

Advanced Placement (AP), 22.06.2019 10:00

English, 22.06.2019 10:00

Mathematics, 22.06.2019 10:00

Mathematics, 22.06.2019 10:00

Mathematics, 22.06.2019 10:00